NiSource

{{#badges: Climate change |CoalSwarm}}

| Type | Public (NYSE: NI) |

|---|---|

| Headquarters | 801 East 86th Ave. Merrillville, IN 46410 |

| Area served | DE, IN, KY, MA, MD, ME, NH, NJ, NY, OH, PA, VA, WV |

| Key people | Robert C. Skaggs Jr., CEO |

| Industry | Natural Gas Distributor Electric Producer & DIstributor |

| Products | Natural Gas, Electricity |

| Revenue | $6.89 billion (2007)[1] |

| Net income | ▲ $321.4 million (2007)[1] |

| Employees | 7,607 (2007) |

| Subsidiaries | Bay State Gas Columbia Gas of Kentucky Columbia Gas of Maryland Columbia Gas of Ohio Columbia Gas of Pennsylvania Columbia Gas of Virginia Columbia Gas Transmission Columbia Gulf Transmission NiSource Retail Services Crossroads Pipeline Energy USA-TPC Kokomo Gas & Fuel NIFL NIPSCO NiSource Energy Technologies Northern Utilities |

| Website | NiSource.com |

NiSource, Inc., based in Merrillville, Indiana, is a Fortune 500 company engaged in natural gas transmission, storage and distribution, as well as electric generation, transmission and distribution. NiSource operating companies deliver energy to 3.8 million customers located within the high-demand energy corridor stretching from the Gulf Coast through the Midwest to New England.[2]

NiSource companies include:[3]

- Columbia Gas (Ohio, Kentucky, Pennsylvania, Maryland, Virginia)

- NIPSCO, "Northern Indiana Public Service Company" (Indiana)

- Bay State Gas (Massachusetts)

- Columbia Gas Transmission

Contents

- 1 Ties to the American Legislative Exchange Council

- 2 CEO compensation

- 3 Power portfolio

- 4 Political contributions

- 5 Existing coal-fired power plants

- 6 Dean Mitchell station to close, pollution controls at three other plants

- 7 Coal waste

- 8 Lobbying and tax subsidies

- 9 Contact details

- 10 Articles and Resources

| Violation Tracker |

|---|

Discover Which Corporations are the Biggest Violators of Environmental, Health and Safety Laws in the United States

Violation Tracker is the first national search engine on corporate misconduct covering environmental, health, and safety cases initiated by 13 federal regulatory agencies. Violation Tracker is produced by the Corporate Research Project of Good Jobs First. Click here to access Violation Tracker. |

Ties to the American Legislative Exchange Council

NIPSCO was a "Director's"-level sponsor of ALEC's 2016 Annual Conference.[4]

| About ALEC |

|---|

ALEC is a corporate bill mill. It is not just a lobby or a front group; it is much more powerful than that. Through ALEC, corporations hand state legislators their wishlists to benefit their bottom line. Corporations fund almost all of ALEC's operations. They pay for a seat on ALEC task forces where corporate lobbyists and special interest reps vote with elected officials to approve “model” bills. Learn more at the Center for Media and Democracy's ALECexposed.org, and check out breaking news on our PRWatch.org site.

|

CEO compensation

In April 2008, Forbes listed NiSource CEO Robert C. Skaggs Jr. as receiving $810,000 in total compensation in the previous fiscal year, with a five-year total compensation of $2.58 million. He ranked 39th on the list of CEOs in the Utility industry, and 498th out of all CEOs in the United States.[5]

Power portfolio

Out of its total 4,079 MW of electric generating capacity in 2005 (0.38% of the U.S. total), NiSource produced 85.1% from coal, 14.5% from natural gas, and 0.5% from hydroelectricity. All of NiSource's power plants are in Indiana.[6]

Political contributions

NiSource is one of the largest energy company contributors to both Republican and Democratic candidates for Congress. These contributions total $151,400 to the 110th US Congress (as of the third quarter), the largest of which has been to Rep. John Boehner (R-OH) for $7,500. Rep. Boehner, for his part, has consistently voted with the coal industry on energy, war and climate bills.[1]

Contributions like this from fossil fuel companies to members of Congress are often seen as a political barrier to pursuing clean energy.

More information on coal industry contributions to Congress can be found at FollowtheCoalMoney.org, a project sponsored by the nonpartisan, nonprofit Oil Change International and Appalachian Voices.

Existing coal-fired power plants

NiSource owned 10 coal-fired generating stations in 2005, with 3,470 MW of capacity. Here is a list of NiSource's coal power plants:[6][7][8]

| Plant Name | State | County | Year(s) Built | Capacity | 2007 CO2 Emissions | 2006 SO2 Emissions |

|---|---|---|---|---|---|---|

| Schahfer | IN | Jasper | 1976, 1979, 1983, 1986 | 1943 MW | 11,000,000 tons | 35,909 tons |

| Bailly | IN | Porter | 1962, 1968 | 604 MW | 3,793,000 tons | 3,309 tons |

| Michigan City | IN | La Porte | 1974 | 540 MW | 3,139,000 tons | 14,841 tons |

| Dean Mitchell | IN | Lake | 1959, 1970 | 384 MW | N/A tons | 7,276 tons |

In 2006, NiSource's 4 coal-fired power plants emitted at least 17.9 million tons of CO2 and 61,000 tons of SO2.

Dean Mitchell station to close, pollution controls at three other plants

On January 13, 2011, the Obama administration brokered a settlement in which Northern Indiana Public Service Co. will permanently shut down an idled coal-fired power plant in Gary, Indana - the Dean Mitchell Generating Station - and spend $600 million to install and improve pollution controls at its three other aging electric generators - Schahfer Generating Station in Wheatfield, Bailly Generating Station in Chesterton, and the Michigan City Generating Station. The improvements will reduce smog- and soot-forming sulfur oxide by 46,000 tons a year and curb lung-damaging nitrogen oxide by 18,000 tons annually, according to the U.S. Environmental Protection Agency. NIPSCO faced legal troubles for upgrading the power plants to keep them operating while failing to install modern pollution controls required under the Clean Air Act's New Source Review provisions. The plants avoided the toughest provisions of the law for decades, in part because regulators assumed during the 1970s that they wouldn’t be running much longer.[9]

The settlement is the 17th negotiated by the EPA and the Justice Department since Obama took office, as part of a national campaign to reduce air pollution from the oldest existing coal plants, some of which date back to the 1940s. Most of the cases have involved utilities in Illinois, Indiana and Ohio. NIPSCO also will pay a $3.5 million fine and spend another $9.5 million on environmental projects, including soot filters for old diesel engines, cleaner woodstoves and restoration of land next to the Indiana Dunes National Lakeshore.[9]

Coal waste

EPA "high hazard" coal waste dam

In November 2011, the EPA released a new set of coal waste data that revealed 181 “significant” hazard dams in 18 states - more than three times the 60 significant-hazard ponds listed in the original database released in 2009. In addition to the increase in the number of significant hazard-rated ponds, eight previously unrated coal ash ponds were found to be high hazard ponds in information released by the EPA earlier in 2011. Because of the switch in ratings after the EPA inspections, the total number of high hazard ponds has stayed roughly the same at a total of 47 ponds nationwide.[10]

According to the National Inventory of Dams (NID) criteria, “high” hazard coal ash ponds are categorized as such because their failure will likely cause loss of human life. Six states that gained high hazard ponds include:[10]

- Indiana: NiSource's Schahfer Generating Station, Wheatfield: 2 high hazard ponds

Lobbying and tax subsidies

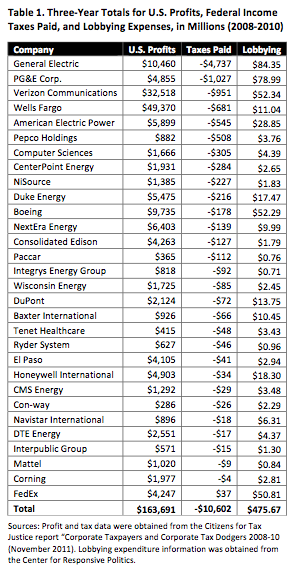

A 2011 analysis by Citizens for Tax Justice and the Institute on Taxation and Economic Policy, "Corporate Taxpayers & Corporate Tax Dodgers: 2008-10" found dozens of companies, including fossil fuels, used tax breaks and various tax dodging methods to have a negative tax balance between 2008 and 2010, while making billions in profits. The study found 32 companies in the fossil-fuel industry -- such as Peabody Energy, ConEd, and PG&E -- transformed a tax responsibility of $17.3 billion on $49.4 billion in pretax profits into a tax benefit of $6.5 billion, for a net gain of $24 billion.[11]

The companies that paid no tax for at least one year between 2008 and 2010 include the utilities Ameren, American Electric Power, CenterPoint Energy, CMS Energy, Consolidated Edison, DTE Energy, Duke Energy, Entergy, FirstEnergy, Integrys, NextEra Energy, NiSource, Pepco, PG&E, PPL, Progress Energy, Sempra Energy, Wisconsin Energy and Xcel Energy.[12]

In December 2011, the organization Public Campaign published a report called "For Hire: Lobbyists or the 99%?" on corporations that have paid more on lobbying than on federal taxes. NiSource ranked ninth (see chart), reporting nearly $1.4 billion in U.S. profits from 2008 to 2010, and collecting $227 million from the U.S Treasury while spending $1.8 million on lobbying;[13] the company had nearly $712 million in tax subsidies, for a tax rate of -16.4%.[14]

Contact details

NiSource Inc.

801 East 86th Avenue

Merrillville, IN 46410

Website: http://www.nisource.com/

Articles and Resources

References

- ↑ Jump up to: 1.0 1.1 NiSource Inc., BusinessWeek Company Insight Center, accessed July 2008.

- ↑ NiSource, "NiSource Corporate Profile", Nisource website, August 2009.

- ↑ NiSource, "Annual Report to the U.S. Securities and Exchange Commission for the year to December 31, 2008", Filed February 27, 2009.

- ↑ Nick Surgey, "ExxonMobil Top Sponsor at ALEC Annual Meeting," Exposed by CMD, Center for Media and Democracy, July 27, 2016.

- ↑ CEO Compensation: #489 Robert C Skaggs Jr, Forbes.com, April 30, 2008.

- ↑ Jump up to: 6.0 6.1 Existing Electric Generating Units in the United States, 2005, Energy Information Administration, accessed April 2008.

- ↑ Environmental Integrity Project, Dirty Kilowatts: America’s Most Polluting Power Plants, July 2007.

- ↑ Dig Deeper, Carbon Monitoring for Action database, accessed June 2008.

- ↑ Jump up to: 9.0 9.1 Michael Hawthorne, "Deal would clear up coal-plant pollution" Chicago tribune, Jan. 13, 2011.

- ↑ Jump up to: 10.0 10.1 Ken Ward Jr., "EPA data reveals more dangerous coal ash ponds" Coal Tattoo, Oct. 31, 2011.

- ↑ Brad Johnson, "Corporate Welfare For Energy Companies Means We Paid $24 Billion In Taxes To Them," Think Progress, Nov. 7, 2011.

- ↑ Robert S. McIntyre, Matthew Gardner, Rebecca J. Wilkins, Richard Phillips, "Corporate Taxpayers & Corporate Tax Dodgers: 2008-10" Citizens for Tax Justice and the Institute on Taxation and Economic Policy, November 2011 Report.

- ↑ Public Campaign, For Hire: Lobbyists or the 99%? How Corporations Pay More for Lobbyists Than in Taxes, organizational report, December 2011

- ↑ Public Interest Research Group and Citizens for Tax Justice, "Representation Without Taxation: Fortune 500 Companies that Spend Big on Lobbying and Avoid Taxes," Public Interest Research Group and Citizens for Tax Justice, January 2012 Report

Related SourceWatch Articles

External Articles

Wikipedia also has an article on NiSource. This article may use content from the Wikipedia article under the terms of the GFDL.