National Restaurant Association

{{#badges:AEX}}The National Restaurant Association (NRA) is a trade association for the approximately $709 billion restaurant industry, according to its own reports,[1][2] and had a total annual revenue of approximately $71 million in 2013.[3] The NRA has been a major force in keeping the federal tipped minimum wage at $2.13 for restaurant workers for 20 years. As discussed below, it and its member companies represent a lobbying powerhouse working against state minimum wage increases and paid sick leave for workers.

The NRA has 53 state restaurant affiliates and operates a nonprofit arm, the National Restaurant Association Educational Foundation, which had a total revenue of $10,622,951 in 2013.[3]

The NRA represents about 500,000 restaurant businesses, according to its website.[4] It has 151 corporate restaurant members, representing the dominant players in this global industry.[5] Other members include supplier companies, faculty and students in hospitality education, and nonprofits "such as state hospitals, state health care facilities, state schools, state prisons, military foodservice establishments, etc."[6] Its members include nine Fortune 500 corporations, seven Fortune 100 corporations, and one Global 500 corporation. Its most recognizable members include industry giants like McDonald's, YUM! Brands (the owner of Taco Bell and KFC), Disney, and Darden Restaurants (the owner of Olive Garden, LongHorn Steakhouse, and Capital Grille, and until a recent "fire sale" also the owner of Red Lobster).[7][8]

Contents

- 1 Partisan Politics in the 2014 Election Cycle

- 2 Budget and Lobbying

- 3 Political Contributions

- 4 Ties to the American Legislative Exchange Council (ALEC)

- 5 NRA Denounces Common Sense NLRB Ruling: If You Work at McDonald's, You Work for McDonald's

- 6 Opposition to Paid Sick Days

- 7 Opposition to Minimum Wage Increases

- 8 Opposition to Nutrition Labeling

- 9 Public Relations: Rick Berman, and Employment Policies Institute

- 10 Other Policies

- 11 Personnel

- 12 Worker Pay Gap

- 13 History with Tobacco

- 14 Herman Cain Controversies

- 15 Member Companies

- 16 Articles and Resources

Partisan Politics in the 2014 Election Cycle

The NRA spent $1,314,500 on the 2014 midterms, and 74 percent went to Republican candidates and committees.[9]

In a press release, CEO and President Dawn Sweeney hailed the results, focusing on the fact that the GOP-dominated Senate would push for lower taxes and reduced health care benefits: "Congratulations to Senator Mitch McConnell and to all the candidates who won victories in yesterday's Midterm elections. The result of this year's elections are critical to the business community - and the restaurant association - on key issues including health care, tax reform and creating a regulatory environment that creates opportunities for businesses to grow."[10]

Budget and Lobbying

The organization generated $71,298,845 in revenue and spent $70,993,503 in 2013, according to the NRA's annual filing with the Internal Revenue Service (IRS).[3]

The NRA spent $2.2 million on lobbying in 2013 and $2.5 million on lobbying in 2014, according to the Center for Responsive Politics.[11] Top issues for lobbying were taxes, health issues, immigration, food industry, and intellectual property.[12] The NRA's lobbying figures do not account for lobbying expenditures or activities by the trade association's individual member companies. Besides its 37 reported in-house lobbyists, the NRA also hired outside lobbyists in 2013, including Capitol Tax Partners, K&L Gates, Mehlman Vogel Castagnettie Inc., and Prime Policy Group (a subsidary of Burson-Marsteller Global Public Relations, which in turn is a WPP-owned company).[13]

In February 2016, the NRA hired the law firm Brownstein Hyatt Farber Schreck, LLP to lead its lobbying. The account was to be headed by "BHFS policy director Brian Wild, former senior advisor to House Speaker John Boehner, who also previously served as deputy assistant for legislative affairs to Vice President Dick Cheney and chief of staff and legislative director for Congressman Pat Toomey (R-PA)," according to O'Dwyer's.[14]

The NRA's reported lobbying figures significantly underestimate the lobbying that it actually engages in, however, thanks to loopholes in lobbying registration and disclosure laws, which The Nation has described as "shadow lobbying":

"In the weeks before fast-food workers earning less than $8 an hour began a wave of walkout strikes across the country in December, the National Restaurant Association, a lobbying group for eateries like McDonald’s and Burger King dedicated to blocking efforts to raise the minimum wage, moved into a swanky new office space on L Street to accommodate its 20 percent growth in staff operations. But even though the National Restaurant Association’s staff and spending have grown, the organization reported its lowest lobbying figures since 2007 on its latest forms."[15]

NRA member companies also spent millions of dollars on lobbying in 2013. Big spenders included McDonald's ($2.3 million), Starbucks ($2.2 million), Darden Restaurants (the parent company of restaurant chains including Olive Garden) ($1.3 million), Dunkin' Brands ($950,000), and YUM! Brands (the parent company of Taco Bell, KFC, and Pizza Hut) ($690,000).[16]

Budget

2013[3]

- Total Revenue: $71,298,845

- Total Expenses: $70,993,503

- Net Assets: $45,451,927

2012[17]

- Total Revenue: $67,841,002

- Total Expenses: $67,774,260

- Net Assets: $44,035,565

2011[18]

- Total Revenue: $91,400,324

- Total Expenses: $65,134,253

- Net Assets: $43,795,680

Political Contributions

The NRA gave $15,788,204 to federal and state political candidates from 1989 through the second quarter of 2014 (with state data covering only through the end of 2013), with 76 percent going to Republicans and 15 percent going to Democrats, according to the Sunlight Foundation. Top recipients have included Heather Wilson (R-NM), John Kline (R-NM), Anne Northrup (R-KY), and John Boehner (R-OH).[19]

In 2014, 18 of the top 20 recipients of NRA money were Republicans (each receiving $7,500 or more), and 18 out of the 20 were men.[20] The NRA gave $967,250 (74 percent) to Republicans and to $334,750 (26 percent) to Democrats during the 2014 cycle.[21] These figures do not account for political contributions from any of the NRA's individual members.

The NRA contributed $3.2 million to state candidates from 1998 to 2014, according to the National Institute on Money in State Politics.[22]

The NRA's biggest PAC contribution at the state level between 1998 and 2014 was a $300,000 donation to the Coalition to Save Florida Jobs in 2004, when that PAC was fighting against a minimum wage increase in the state, according to the National Institute on Money in State Politics.[23] The second-biggest PAC contribution ($293,000) went to the Republican Party of Florida, according to the Colorado Secretary of State Elections Division. The NRA gave $160,080 during the 2011-2012 period, just before the legislature pushed a bill to preempt and block paid sick day legislation. It also contributed $50,000 in October 2006 to Respect Colorado's Constitution, a political committee fighting to keep the state from raising the minimum wage.[24]

The NRA also runs its own PAC, the National Restaurant Association PAC (Restaurant PAC).[25] During the 2014 election cycle, Restaurant PAC received $1,295,248 in donations, with $959,887 coming from individual donors giving $200 or more.[25] It spent $1,285,555 during the 2014 election cycle, giving $964,250 to federal candidates.[25]

Lobbying and Political Contributions Expenditures Breakdown

2014 Election Cycle

National Restaurant Association[26]

- 2014 Total Lobbying Expenditures: $2,551,996

- 2013 Total Lobbying Expenditures: $2,238,691

- Total Contributions: $1,314,500

- Contributions to Republicans: $967,250

- Contributions to Democrats: $334,750

- Declared 2013 Lobbying Expenditures: $820,106[3]

National Restaurant Association PAC[27]

- Total Receipts: $1,295,248

- Total Spent: *$1,285,555

- PAC Contributions to Federal Candidates: $964,250

2012 Election Cycle

National Restaurant Association[28]

- 2012 Total Lobbying Expenditures: $2,709,311

- 2011 Total Lobbying Expenditures: $2,549,500

- Declared 2012 Lobbying Expenditures: $1,007,120[29]

- Declared 2011 Lobbying Expenditures: $1,184,114[30]

National Restaurant Association PAC[31]

- Total Receipts: $1,234,546

- Total Spent: $1,056,179

- PAC Contributions to Federal Candidates: $803,000

Grants and Donations:

2013[3]

- Georgetown University: $50,000

- State Legislative Leaders Foundation: $30,000

- Cornell University School of Hotel Administration: $25,000

- Partnership for Food Safety Education: $25,000

- Women's Foodservice Forum: $22,000

- NCSL Foundation for State Legislatures: $17,500

- Human Rights Campaign Foundation: $15,000

- University of Alabama at Birmingham: $25,000

- Ovarian Cancer National Alliance: $10,000

- SOME Gala Offices: $10,000

- Mt Vernon Ladies: $10,000

- National Restaurant Association Educational Foundation: $130,000

- National Restaurant Association Military Foundation: $75,000

2012[32]

- Campaign to End Obesity: $40,000

- Democratic Governors Association: $10,000

- Grocery Manufacturers Association: $20,000

- Illinois Restaurant Association Political Action Committee: $15,000

- Mt. Vernon Ladies Association: $10,000

- Ovarian Cancer National Alliance: $10,000

- The Culinary Institute of America: $10,000

- Women's Foodservice Forum: $20,000

Ties to the American Legislative Exchange Council (ALEC)

The NRA is a member of ALEC.[33] According to the NRA’s 990 filling with the IRS, they gave $7,000 to ALEC in 2011. At ALEC’s Annual Meeting in August 2011, Stan Harris, president and CEO of the Louisiana NRA affiliate, was a speaker at the Labor and Business Regulation Subcommittee meeting, and legislators were handed a target list and map of state and local paid sick days policies prepared by the NRA.

| About ALEC |

|---|

ALEC is a corporate bill mill. It is not just a lobby or a front group; it is much more powerful than that. Through ALEC, corporations hand state legislators their wishlists to benefit their bottom line. Corporations fund almost all of ALEC's operations. They pay for a seat on ALEC task forces where corporate lobbyists and special interest reps vote with elected officials to approve “model” bills. Learn more at the Center for Media and Democracy's ALECexposed.org, and check out breaking news on our PRWatch.org site.

|

NRA Denounces Common Sense NLRB Ruling: If You Work at McDonald's, You Work for McDonald's

On July 28, 2014, the general counsel of the National Labor Relations Board (NLRB) ruled that McDonald's is a joint employer and authorized complaints in 43 cases against McDonald's.[34] The ruling means that McDonald's "could be held jointly liable for labor and wage violations by its franchise operators," according to the New York Times,[35] and may also "give employees more leverage to unionize."[36] McDonald's has stated that it would appeal the ruling, while trade groups including the NRA and the National Retail Federation denounced the ruling as harmful to businesses. An NRA spokesperson said, "The net effect is counterproductive and will indeed create ‘big business.'"[36]

Opposition to Paid Sick Days

In recent years, the NRA has fought hard against new laws and regulations on paid sick days , which would allow workers to stay at home when sick without risking their paycheck or their job. The NRA has called paid sick days fights a “hot button issue for the restaurant industry.” [37]

Forty percent of all workers do not have paid sick days; existing federal law covers only employees working 25 hours or more at businesses with at least 50 workers, applies only to serious and not routine illnesses, and is unpaid. [38]

Bills to block local governments from allowing workers to earn paid sick days have been introduced in at least 14 different state legislatures across the country; in most cases, the NRA has played a role in pushing the legislation.[39][40] These bills are designed to preempt local governments or voters from enacting paid sick days ordinances.

The preemption concept was promulgated in August 2011 at an ALEC meeting in New Orleans.[41] Legislators attending a meeting of the ALEC Labor and Business Regulation Subcommittee were handed a copy of a bill that had passed in Wisconsin months earlier, thanks to a lobbying effort by the Chamber and restaurant industry.[41] The bill preempted any local paid sick day laws, and overturned a Milwaukee paid sick days ordinance that had passed with nearly 70 percent of the vote in 2008.[41] (See Preemption for more.)

Stan Harris, president and CEO of the Louisiana NRA affiliate, was a speaker at the meeting, and legislators were handed a target list and map of state and local paid sick days policies prepared by the NRA.[42] After that meeting, similar paid sick days preemption bills spread across the country, in most cases introduced and co-sponsored by ALEC member legislators.

- Alabama: the Alabama Restaurant Association is pushing a preemption bill to stop local paid sick days ordinances.[43]

- Arizona: Arizona media reported that the restaurant industry is behind preemption bill.[44] The Arizona Restaurant Association testified in support of the bill.[45]

- Colorado: The NRA contributed $100,000 to Keep Denver Competitive, a business coalition formed specifically to fight a paid sick days ballot measure. [46]

- Connecticut: the Connecticut Restaurant Association lobbied vigorously against a paid sick days law passed in 2011.[47]

- Florida: the preemption bill was written with the help of Darden, the parent company for Olive Garden and Red Lobster.[48]

- Indiana: the Indiana Restaurant and Lodging Association pushed to pass the preemption bill.[49]

- Kansas: the Kansas Restaurant & Hospitality Association (KRHA) wrote a letter to governor asking him to support preemption bill.[50]

- Louisiana: the Louisiana Restaurant Association gave $2,750 to preemption bill sponsor. The LRA is a sponsor of ALEC and the LRA CEO spoke at the ALEC meeting in 2011 where a preemption model bill was distributed.[51]

- Michigan: The Michigan Restaurant Association commended passage of preemption legislation in the House[52]and testified in favor in a Senate hearing.[53]

- Mississippi: while there is no confirmed link to the restaurant industry, the bill’s sponsor[54] on preemption, Representative Turner is a confirmed member of ALEC and has received campaign donations from ALEC.[55]

- Oklahoma: State Senate sponsor for paid sick days and minimum wage preemption bill[56] received campaign donations from the Oklahoma Restaurant Association.[57]

- South Carolina: The sponsor of a state preemption bill[58]has been on multiple ALEC committees.[59][60]

- Tennessee: Tennessee Hospitality Association worked to pass preemption bill.[61] Sponsors of the bill received campaign donations from Tennessee Hospitality Association (log in required on TN web page).

- Washington: the Washington Restaurant Association fought against the Seattle paid sick days ordinance.[62]

- Wisconsin: the Wisconsin Restaurant Association worked to help pass preemption bill against paid sick days.[63]

In April 2011, the NRA created a Restaurant Advocacy Fund to provide a rapid response capability to state-level initiatives it opposes, including bringing paid sick days to employees. [64] Scott DeFife, the NRA’s Executive Vice President for Policy and Government Affairs, has said that the Restaurant Advocacy Fund will be used to challenge “an increasing number of complex issues that threaten restaurants’ bottom-line.” [65]

Paid Sick Leave Preemption Bills and Sponsors, 2011-2013

| State (Year) | Bill(s) | ALEC Member Sponsors | Status |

|---|---|---|---|

| WI (2011) | AB 41/SB 23 | Kapenga, Stone, Honadel; Vukmir, Grothman, Darling, Lazich | Enacted 2011 |

| LA (2012) | SB 521 | Enacted 2012 | |

| AL (2013) | HB 628 | Died | |

| AZ (2013) | HB 2280 | Forese | Enacted 4/29/13 |

| FL (2013) | HB 655/SB 726 | Precourt, Mayfield; Simmons | Enacted 6/14/13 |

| IN (2013) | SB 213 | Enacted 4/25/13 | |

| KS (2013) | HB 2069 | Commerce, Labor, Econ Development Committee Chair Marvin Kleeb | Enacted 4/16/13 |

| MI (2013) | HB 4249/SB 173 | Lori; M. Green, Meekhoff, Robertson, M. Kowall | Passed House & Senate committees, no floor votes yet |

| MS (2013) | HB 141 | Turner | Enacted 3/25/13 |

| OK (2013) | SB 1023 | Died | |

| SC (2013) | H 3941 | Sandifer, Harrell, Bannister | Passed House 4/30/13, died |

| TN (2013) | HB 501/SB 35 | Kelsey, White, Lynn | Enacted 4/16/13 |

| WA (2013) | SB 5728 | Padden, Bailey, Benton | Died |

| WA (2013) | HB 1781/SB 5726 | Bailey, Padden, Benton | Reintroduced and retained in present status May 13 |

| WA (2013) | SB 5159 | Bailey, Padden; Becker, Carrell (deceased), Parlette, Holmquist | Reintroduced and retained in present status May 13 |

Opposition to Minimum Wage Increases

The National Restaurant Association has continually fought against proposed increases to the minimum wage. In the 1990s, it helped persuade Congress to set the minimum wage for tipped workers at just $2.13 an hour, where it has stayed for decades.[66]

- Federal (2014): The NRA opposes increasing the national minimum wage to $10.10, which was proposed in the Minimum Wage Fairness Act bill authored by Senator Tom Harkin and Representative George Miller and supported by President Obama.[67]

- Oklahoma (2014): The Oklahoma Restaurant Association supported 2014 S.B. 1023, which prevents municipalities from establishing a local minimum wage or minimum number of sick days.[68] Oklahoma Restaurant Association President and CEO Jim Hopper supported the bill, saying the "(minimum wage is) a state-level issue... It's not something that should be done by municipalities... If (chain restaurants) have to deal with each city having a different minimum wage, then they would face a payroll nightmare."[69]

- Colorado (2006): The NRA contributed $173,000 the Hospitality Issues PAC (HIPAC) and $50,000 to Respect Colorado's Constitution, the two committees opposed to increasing Colorado's minimum wage.[70] Amendment 42 increased Colorado's minimum wage from $5.15 to $6.85 per hour and indexed it to inflation.[71] The Respect Colorado's Constitution opposition committee spent $1.5 million against the minimum wage increase, and HIPAC spent another $1.06 million.[72] The Colorado Restaurant Association contributed $1.0 million to Respect Colorado's Constitution and $449,000 to HIPAC, making it the largest financial opponent to the minimum wage increase.[73] Amendment 42 was passed by 53 percent of Colorado voters.[74]

- Arizona (2006): The NRA donated $170,000 to No on 202 Opposed to I-13-2006 (also known as Jobs First Against I-13-2006).[75] This committee spent $1.1 million in opposition to Arizona Proposition 202, a ballot initiative which increased the state minimum wage from $5.15 to $6.75 per hour, with an annual cost of living increase.[76] Arizona voters approved the measure with 65 percent voting in favor.[77] Other large donors to No on 202 Opposed to I-13-2006 included the Arizona Chamber of Commerce ($121,000), Arizona Restaurant & Hospitality Association ($117,400), and Outback Steakhouse ($90,000).[78]

- Ohio (2006): The NRA contributed $100,000 to Ohioans to Protect Personal Privacy.[79] This committee spent $1.8 million against 2006 Issue 2, which increased the minimum wage to $6.85 per hour and indexed it to inflation.[80] The minimum wage increase passed with 56 percent of the vote.[74] Other large donors to Ohioans to Protect Personal Privacy included the National Federation of Independent Business ($245,000), Northeastern Ohio McDonald's Advertising Association ($107,000), Outback Steakhouse ($75,000), and Procter & Gamble ($75,000).[81]

- Nevada (2006): The NRA gave $50,000 to Nix 6 - Nevadans Against Question 6.[82] Question 6 raised the Nevada minimum wage to $5.15 per hour if the employer provides health benefits or $6.15 per hour if the employer does not, with an annual cost of living adjustment.[83] Nix 6 spent $361,325 to oppose the increase and was also funded by 7-Eleven ($45,250), Outback Steakhouse ($30,000), and Jack in the Box ($30,000).

- Missouri (2006): The NRA contributed $40,000 to Save Our State's Jobs, which campaigned against Missouri's Proposition B.[84] Proposition B increased the state's minimum wage to $6.50 per hour and indexed it to inflation and was passed by 76 percent of voters.[85] Save our State's Jobs raised a total of $149,900, with other large contributors including Outback Steakhouse ($30,000), Darden Restaurants subsidiary GMRI ($25,000), and McDonald's of Metro St. Louis ($16,800).[86]

- Montana (2006): The NRA donated $20,000 to the Coalition Against Continual Price Increases: No on I-151.[87] This group spent $99,715 against I-151,[88] which raised Montana's minimum wage from $5.15 per hour to $6.15 per hour and indexed it to inflation, and was approved by 73 percent of voters.[74]

- Florida (2004): The NRA contributed $300,000 to the Coalition to Save Florida Jobs, a business-funded group which opposed an increase to the state's minimum wage.[89] The Coalition raised $4.1 million, with other large contributors including Publix Supermarkets ($500,000), Outback Steakhouse ($400,000), Darden Restaurants subsidiary GMRI ($300,000), Florida Retail Federation ($160,000), Florida Restaurant Association ($110,000), Florida Chamber of Commerce ($100,425), Burger King ($100,000), CVS ($100,000), Walgreens ($100,000), and the Walt Disney Company ($100,000).[90]

Opposition to Nutrition Labeling

In 2011, the Food and Drug Administration (FDA) proposed regulations for national standards for nutrition labeling on menus.[91] Restaurant food is often high saturated fats, trans fat, salt and calories.[92] The NRA has fought numerous efforts to introduce calorie and fat content labeling on restaurant menus, defeating thirteen nutrition-labeling bills introduced in eleven states and two cities (Washington, D.C. and Philadelphia).[92] To help in this effort, the NRA offered an "Obesity Issue Kit" that included model legislation, op-ed articles, talking points and other resources designed to assist states in passing legislation and to shield the industry.[92]

In 2012, ALEC adopted a “model” act to preempt local governments from enacting nutrition labeling requirements. [93]

When New York State attempted to establish menu labeling requirements, the NRA sued the state government.[8]

Public Relations: Rick Berman, and Employment Policies Institute

The NRA operates the National Restaurant Association Educational Foundation (NRAEF), which is set up as the association’s "educational arm."[94] In 2010, the NRA announced strategic partnership with Nation's Restaurant News, a restaurant industry trade publication.[95] The NRN regularly carries articles on industry efforts to turn back paid sick days requirements,[96][97] minimum wage initiatives and legislation,[98] healthcare reform, and employee organizing rights.[99] Richard Berman, the prominent anti-union public relations operative who represents restaurant chains,[100][101] has written a column for years in Nation's Restaurant News.

Berman is also president and CEO of the Employment Policies Institute (EPI), which pushes NRA-favored policies like opposition to minimum wage increases and paid sick days. EPI is a Berman front group that writes articles in opposition to higher wages and paid sick leave nationwide, posing as an academic think tank. The National Journal has described EPI as "another new think tank with even closer ties to industry… started in 1992 by a group of restaurant companies that wanted an alternative source of research on labor issues." According to the National Journal, in 1995, EPI got "95% of its budget from corporate sources -- primarily restaurateurs and retailers."[102] EPI operates from the same address (1090 Vermont Ave. NW, Suite 800, Washington, D.C. 20005)[103] as Berman and Company, the PR firm Berman owns.[104]

Other Policies

In addition to trying to block paid sick leave initiatives, the NRA's top advocacy issues have included repealing the Affordable Care Act, fighting the Department of Labor's tip credit notification regulations,[105][106] and opposing Restaurant Opportunities Centers United (ROC-United), a national restaurant workers' organization headquartered in New York. A January 2014 meeting report provided to Salon revealed that the NRA's Jobs & Careers Committee and its Restaurant PAC both "recommended that the Restaurant Advocacy Fund provide $600,000 in additional support for the ongoing project to combat the tactics of the Restaurant Opportunities Centers, or ROC, and the new industry reputational campaign."[107]

ROC United itself reported, "The NRA has also weighed in on regulations they think will affect their bottom line -- for example, they sought an exemption from the requirement that they provide adequate space in their restaurants for nursing mothers."[108]

The NRA also opposes limitations on the marketing of junk food to children, and regulation of sodium, sugar, and trans-fats in processed foods.[109] The NRA called New York City's legislative ban on trans fats in processed foods "misguided social engineering" despite the fact that the American Heart Association recommends that trans fat intake, which increases the risk of Type 2 diabetes and stroke, be limited to naturally occurring sources, leaving "virtually no room at all for industrially manufactured trans fats."[8]

Opposition to the Affordable Care Act

The NRA has opposed the Affordable Care Act, claiming in 2010 that it "would severely and negatively impact restaurants by weakening the small business exemption, increasing penalties on employers, and imposing onerous administrative burdens on the industry."[110] The NRA has often presented its arguments as a representative of small business owners. For example, its representative to a 2013 U.S. House of Representatives hearing on the ACA's effects on businesses, Tom Boucher, introduced himself as "an independent restauranteur" who got his start as a server with the company he now heads, Great NH Restaurants.[111] Boucher's testimony concluded that "the law cannot stand as it is today given the challenges employers such as restaurant and foodservice operators face in implementing it," highlighting new taxes and reporting requirements as particularly onerous.[112]

In July 2014, the NRA pushed a bill that would end auto-enrollment for employees of large businesses, opposing auto-enrollment as too burdensome for employers. NRA co-signed a letter by the Retail Industry Leaders Association advocating the change. NRA spokesperson Scott DeFife said, "As it stands, the auto-enrollment requirement will have damaging impacts on both restaurant owners and their employees -- leaving much misinterpretation for employees about their decision on coverage and creating additional administrative burdens for employers."[113]

Opposition to New York City Soda Regulation

In September 2012, then-mayor of New York City Michael Bloomberg enacted rules setting a maximum size of 16 ounces for sweetened beverages like soda and flavored coffee drinks. Bloomberg presented the measure as part of an anti-obesity campaign, as the New York Times reported.[114] The NRA opposed the "beverage ban," citing "customer confusion and operational difficulties" if the rules went into effect.[115] The NRA joined a lawsuit against the regulation,[116] and in June 2014, it was struck down by the New York Court of Appeals. The NRA hailed the decision as "a victory for the city's restaurants and suppliers."[117]

Personnel

- Dawn Sweeney - President and CEO, formerly President and CEO of AARP Services, the taxable subsidiary of the AARP.[118] According to the NRA 990 filings with the IRS, the organization paid Ms. Sweeney $2,098,003 million in total compensation in 2013.[3]

- Marvin Irby - CAO and CFO,[119] formerly with Shawmut Design & Construction, Walt Disney Word, and PepsiCo.[120] According to the NRA 990 filings with the IRS, the organization paid Mr. Irby $691,899 in total compensation in 2013.[3]

- Scott DeFife - Executive Vice President for Policy & Government Affairs, formerly Government Affairs for the Securities Industry and Financial Markets Association (SIFMA), former staffer for Congressman Steny Hoyer (D-MD), Congressman Bart Gordon (D-TN), Congresswoman Karen McCarthy (D-MO), and Congressman Mike Andrews.[121] According to the NRA 990 filings with the IRS, the organization paid Mr. DeFife $729,121 in total compensation in 2013.[3]

- Sue Hensley - Senior Vice President of Public Affairs and Communications, formerly Chief Spokesperson of the Small Business Administration, Office of Public Affairs at the U.S. Department of Labor, and Spokesperson to Senator Tim Hutchinson (R-AR).[122]

- David Matthews - Executive Vice President and General Counsel, formerly senior vice president for technology and operations of the Federal Home Loan Bank of Chicago and president and chief operating officer of RBC Mortgage Company.[123] According to the NRA 990 filings with the IRS, the organization paid Mr. Matthews $407,323 in total compensation in 2013.[3]

- Peter Kilgore - General Counsel and Corporate Secretary. According to the NRA 990 filings with the IRS, the organization paid Mr. Kilgore $467,330 in total compensation in 2013.[3]

- Robert Gifford - Executive Vice President Philanthropic Initiatives. According to the NRA 990 filings with the IRS, the organization paid Mr. Gifford $541,912 in total compensation in 2013.[3]

- Mary Pat Heftman - Executive Vice President Convention and Strategic Alliances. According to the NRA 990 filings with the IRS, the organization paid Ms. Heftman $547,809 in total compensation in 2013.[3]

- James Balada - Senior Vice President Innovation and Business Development. According to the NRA 990 filings with the IRS, the organization paid Mr. Balada $436,225 in total compensation in 2013.[3]

- Edward Beck - Chief Information Officer and Senior Vice President of Technology. According to the NRA 990 filings with the IRS, the organization paid Mr. Beck $305,626 in total compensation in 2013.[3]

- Dawn Cacciotti - Senior Vice President HR. According to the NRA 990 filings with the IRS, the organization paid Ms. Cacciotti $285,831 in total compensation in 2013.[3]

- Philip Kafarakis - Chief Innovation and Member Advancement Officer. According to the NRA 990 filings with the IRS, the organization paid Mr. Kafarakis $179,958 in total compensation in 2013.[3]

- Hudson Reihle - Senior Vice President Research and Knowledge. According to the NRA 990 filings with the IRS, the organization paid Mr. Reihle $341,477 in total compensation in 2013.[3]

- Susan Robusto - RVP Public Affairs and Communications. According to the NRA 990 filings with the IRS, the organization paid Ms. Robusto $325,879 in total compensation in 2013.[3]

- Angelo Amador - Vice President Labor and Workforce Policy. According to the NRA 990 filings with the IRS, the organization paid Mr. Amador $257,079 in total compensation in 2013.[3]

- Joan McGlockton - Vice President Industry Affairs and Food Policy. According to the NRA 990 filings with the IRS, the organization paid Ms. McGlockton $293,253 in total compensation in 2013.[3]

Worker Pay Gap

In 2012, the Economic Policy Institute released a report on the growing income inequality between company executives and their employees. From 1978 to 2011, worker annual compensation rose by just 5.7 percent while the annual income of CEOs over the same time period rose by 726.7 percent, more than 127 times the rate of income rise of workers.[124]

According to estimates released by the Bureau of Labor Statistics in May 2014, the annual mean wage for waiters and bartenders was $21,640 and $22,620, respectively. Top pay in the industry is earned by chefs and head cooks at $45,880 (other cooks and food preparation workers made an annual mean wage of $22,310).[126]

Comparing these employee salaries to annual compensation of Dawn Sweeney, the CEO of the National Restaurant Association:

- NRA CEO-to-waiter compensation equals 101-to-1

- NRA CEO-to-bartender compensation equals 97-to-1

- NRA CEO-to-chef compensation equals 45-to-1.

The following numbers are from the EPI 2012 report:[124]

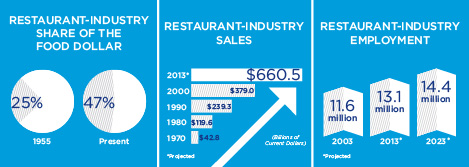

- $660.5 billion: Restaurant-industry sales projected for 2013. (Approximately $709 billion today)

- 980,000: Number of restaurant locations in the United States.

- 4%: Restaurant-industry sales share of the U.S. gross domestic product.

- $1.8 billion: Restaurant-industry sales on a typical day in 2013.

- 13.1 million: Number of restaurant-industry employees.

- 47%: Restaurant-industry share of the food dollar.

- 93%: Percentage of eating and drinking places with fewer than 50 employees.

Public Assistance for Restaurant Employees

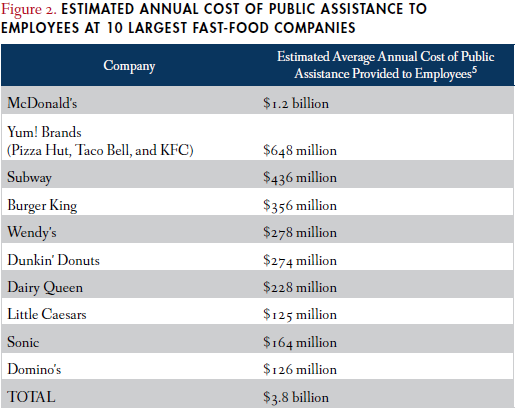

Nearly 60 percent of the $700 billion restaurant industry's employees are low-wage workers, and over half of the nation's fast food workers relies on at least one form of public assistance, according to the Kansas City Star's coverage of an Institute for Policy Studies report.[127] The National Employment Law Project estimates that the public assistance provided to fast food workers costs taxpayers at least $3.8 billion a year, and taxpayers fund McDonald's employees to the tune of $1.2 billion a year in public assistance.[128]

The Institute for Policy Studies' April 2014 study noted the huge disparity between pay of CEOs and employees, noting, "During the past two years, the CEOs of the 20 largest NRA members pocketed more than $662 million in fully deductible 'performance pay,' lowering their companies' IRS bills by an estimated $232 million. That would be enough to cover the cost of food stamps for more than 145,000 households for a year."[129] Sarah Anderson, a co-author of the study, said, "These restaurant CEOs aren't the only executives gorging on taxpayer-subsidized bonuses... But their pay practices deserve extra scrutiny because of the high social costs of this industry's low-wage model -- a model they're seeking to preserve by fighting minimum wage increases."[130]

History with Tobacco

According to a study published in the British Medical Journal, the tobacco industry often used groups such as the NRA to act as fronts for tobacco interests.[131] For instance, Philip Morris sent a letter to the NRA in 2000 regarding a program to create ventilated interiors instead of smoke-free restaurants. The letter mentions a $250,000 check from Philip Morris to the NRA.[132]

A search of the Legacy Tobacco Documents Library at the University of California-San Francisco finds over 6,000 documents that reference the NRA.[133]

Herman Cain Controversies

The NRA was led by Herman Cain from 1996 to 1999. Controversies -- including charges of sexual harassment and overspending -- swirled about his tenure at the association when he ran for president in 2012. Cain alleged that the sexual harassment leaks were coming from an opponent in the race.[134][135]

Former employees told Bloomberg News that Cain's work-related outings involved heavy drinking, lavish spending, and large expenses, angering some board members.[135] The NRA released a statement confirming that they agreed to a settlement with one employee regarding allegations that Cain sexually harassed her.[136]

Member Companies

As of March 2015, NRA members include:[137]

- 7-Eleven, Inc.

- AFC Enterprises dba Popeyes

- All American Specialty Restaurants

- American Food & Vending

- AmRest Applebee's LLC

- Anthony's Coal Fire Pizza

- ARAMARK Corporation

- Arby's Restaurants

- Arby's/U.S. Beef

- Beef O' Brady's Family Sports Concepts Inc.

- Benihana Inc.

- Bennigan's Franchising Co

- Big Boy Restaurants International

- Bloomin' Brands, Inc.

- Bob Evans Farms, Inc.

- Bojangles' Restaurants, Inc.

- Boston Pizza Restaurants, LP

- Bravo/Brio Restaurant Group

- Brinker International

- Buffalo Wild Wings, Inc.

- Buffalo Wings & Rings LLC

- Buffets, Inc.

- Burger King Corporation

- Cajun Operating Company

- Cameron Mitchell Restaurants

- Carlson Restaurants Worldwide TGI Friday's Inc.

- Centerplate

- Checkers Drive-In Restaurants, Inc

- Chick-fil-A, Inc.

- Chipotle

- CiCi Enterprises

- Compass Group

- Concessions International

- Connor Concepts Corporate Office The Chop House

- Corner Bakery Cafe

- Cousins Submarines, Inc.

- Cracker Barrel Old Country Store, Inc.

- CraftWorks Restaurants and Breweries, Inc.

- Culver Franchising System, Inc.

- Darden Restaurants, Inc.

- Dave & Buster's

- Delaware North Companies, Inc.

- Denny's

- Domino's Pizza, Inc.

- Donatos Pizza

- Dunkin' Brands, Inc.

- The Dussin Group dba The Old Spaghetti Factory

- Einstein Noah Restaurant Group, Inc.

- Elmer's Restaurants, Inc.

- Emeril's Restaurant

- Famous Dave's of America

- Fired Up, Inc.

- Firehouse Subs of America, LLC

- First Watch Restaurants

- Focus Brands, Inc/Roark Capital Group

- Food Concepts International, Inc. dba Abuelo's Mexican Food Embassy

- Friendly's Ice Cream Corp.

- Frisch's Restaurants, Inc.

- Gosh Enterprises / Charley's Grilled Subs

- Ground Round I.O.C.

- Guest Services, Inc.

- Hard Rock International, Inc.

- The HBH Franchise Company, LLC HoneyBaked Ham Co. and Cafe

- Heart of America Restaurants & Inns

- HMSHost

- Hooters of America, Inc.

- Huddle House, Inc.

- Hyatt Hotels Corporate Office

- In The Sauce Brands, Inc.

- In-N-Out Burger

- International Dairy Queen

- Investors Management Corporation Golden Corral

- Jackmont Hospitality, Inc.

- Jamba Juice Company

- Kolache Factory, Inc.

- Krispy Kreme Doughnut Corporation

- The Krystal Company

- La Rosa's, Inc.

- Landry's Restaurants, Inc

- Le Duff America

- Ledo Pizza System Inc.

- Lettuce Entertain You

- Little Caesar's Enterprises, Inc.

- Logan's Roadhouse, Inc.

- Long John Silver's, LLC

- Luby's Restaurants

- Macy's Food Division 1143

- Mainstreet Ventures, Inc.

- Marriott International

- Mazzio's Corporation

- McCormick & Schmick Management

- McDonald's Corporation

- Melting Pot Restaurants

- Morton's of Chicago National Headquarters

- Mr. Goodcents Franchise Systems, Inc.

- Noodles & Company

- Nordstrom Restaurant Division

- O'Charley's, Inc.

- Original Pancake House Franchising Inc.

- Panera, LLC

- Papa Gino's, Inc.

- Papa John's International Inc.

- Papa Murphy's International, Inc.

- Pappas Restaurants

- Perkins & Marie Callender's, Inc

- PF Chang's China Bistro

- Phillips Food, Inc.

- Piccadilly Cafeterias Inc.

- Pita Pit USA

- Pizza Fusion Holdings

- Plamondon Enterprises, Inc.

- Platinum Corral, LLC

- Potbelly Sandwich Works

- Quaker Steak & Lube Best Wings USA Inc

- Quizno's Master LLC

- Raising Cane's

- Red Robin International

- Romacorp, Inc.

- Rosati's Pizza

- Ruby Tuesday, Inc

- Salsarita's Franchising, LLC

- Sbarro, Inc.

- Select Restaurants, Inc.

- Shari's Management Corporation

- Smashburger Master LLC

- Smith & Sons Foods, Inc.

- Sodexo, Inc.

- Sonic Industries, Inc.

- Sonny's Real Pit Bar-B-Q

- Starbucks Coffee Company

- Stockade Companies

- Subway Sandwiches and Salads

- Taco John's International, Inc.

- Taco Mayo Franchise Sys., Inc.

- Ted's Montana Grill LLC

- Texas Roadhouse

- Tilted Kilt Pub & Eatery

- Tim Hortons Inc.

- Uno Restaurant Corporation

- Valentino's

- Viad Corp

- Waffle House Corp

- Walt Disney World Company

- We're Rolling Pretzel Company, WRPC, Inc.

- Wendy's International

- Whataburger Restaurants, LP

- White Castle System,Inc

- Wingstop Restaurants Inc

- Yum! Brands, Inc.

- Zaxby's Franchising, Inc.

Articles and Resources

Related SourceWatch Articles

- Paid Sick Leave

- Job Creators Network

- International Franchise Association

- National Restaurant Association Educational Foundation

- American Legislative Exchange Council

References

- ↑ National Restaurant Association, "Positive outlook for 2015," organizational press release, January 27, 2015.

- ↑ National Restaurant Association, "Facts at a Glance," organizational website, accessed March 25, 2015.

- ↑ 3.00 3.01 3.02 3.03 3.04 3.05 3.06 3.07 3.08 3.09 3.10 3.11 3.12 3.13 3.14 3.15 3.16 3.17 3.18 3.19 3.20 National Restaurant Association, "2013 IRS Form 990," organizational annual IRS filing, November 14, 2014. Cite error: Invalid

<ref>tag; name "2013 990" defined multiple times with different content Cite error: Invalid<ref>tag; name "2013 990" defined multiple times with different content Cite error: Invalid<ref>tag; name "2013 990" defined multiple times with different content - ↑ National Restaurant Association, Membership FAQ, organizational website, accessed April 7, 2015.

- ↑ National Restaurant Association, "Federal Lobbying Disclosure Act," organizational website, accessed March 31, 2015.

- ↑ National Restaurant Association, "Join: Categories," organizational website, accessed March 31, 2015.

- ↑ Michael J. de la Merced, "Darden to Sell Red Lobster in a $2.1 Billion Dea," New York Times, May 16, 2014.

- ↑ 8.0 8.1 8.2 Restaurant Opportunities Centers United, "Unmasking the Agenda of the National Restaurant Association," organizational report, April 28, 2014.

- ↑ Center for Responsive Politics, "Total Contributions by Party of Recipient," OpenSecrets.org, accessed January 30, 2015.

- ↑ National Restaurant Association, "National Restaurant Association Statement on Midterm Election Results," organizational press release, November 5, 2014.

- ↑ Center for Responsive Politics, "Client Profile: Summary, 2014," OpenSecrets.org lobbying database, accessed March 25, 2015.

- ↑ Center for Responsive Politics, "Client Profile: Summary, 2014," OpenSecrets.org lobbying database, accessed March 25, 2015.

- ↑ Center for Responsive Politics, "Lobbyists Representing National Restaurant Assn, 2013," OpenSecrets.org lobbying database, accessed March 25, 2015.

- ↑ Jon Gingerich, "BHFS Serves National Restaurant Association," O'Dwyer's, February 16, 2016.

- ↑ Lee Fang, "Where Have All the Lobbyists Gone?," The Nation, February 19, 2014.

- ↑ Center for Responsive Politics, "Restaurants & Drinking Establishments," OpenSecrets.org lobbying database, accessed March 31, 2015.

- ↑ National Restaurant Association, "2012 IRS Form 990," organizational tax filing, November 15, 2013.

- ↑ National Restaurant Association, "2011 IRS Form 990," organizational tax filing, November 14, 2012.

- ↑ Sunlight Foundation, "National Restaurant Association," Influence Explorer, accessed April 7, 2015.

- ↑ Center for Responsive Politics, "National Restaurant Association Money to Congress: 2014 Cycle", OpenSecrets.org political influence database, accessed March 25, 2015.

- ↑ Center for Responsive Politics, "National Restaurant Assn Summary: Totals," OpenSecrets.org political influence database, accessed March 25, 2015.

- ↑ National Institute on Money in State Politics, "National Restaurant Association Contributions", "Follow the Money", accessed April 7, 2015.

- ↑ National Institute on Money in State Politics, "Contributor: National Restaurant Association", "Follow the Money", accessed April 7, 2015.

- ↑ Colorado Secretary of State Elections Division, "National Restaurant Association contribution to Respect Colorado’s Constitution," accessed February 25, 2014.

- ↑ 25.0 25.1 25.2 Center for Responsive Politics, "National Restaurant Association PAC: Summary," Opensecrets database, accessed March 31, 2015.

- ↑ Center for Responsive Politics, "Client Profile: Summary, 2014," Lobbying, Opensecrets database, accessed March 25, 2015.

- ↑ Center for Responsive Politics, "Summary PAC Data: 2014," Opensecrets database, accessed March 25, 2015

- ↑ Center for Responsive Politics, "Client Profile: Summary, 2012," Lobbying, Opensecrets database, accessed March 25, 2015.

- ↑ National Restaurant Association, "2012 IRS Form 990," organizational tax filing, November 15, 2013.

- ↑ National Restaurant Association, "2011 IRS Form 990," organizational tax filing, November 14, 2012.

- ↑ Center for Responsive Politics, "Summary PAC Data: 2012," Opensecrets database, accessed March 25, 2015

- ↑ National Restaurant Association, "2012 IRS Form 990," organizational tax filing, November 15, 2013.

- ↑ Clearinghouse on Environmental Advocacy and Research, Information on American Legislative Exchange Council, archived organizational profile, December 2, 2000.

- ↑ Office of the General Counsel, NLRB Office of the General Counsel Authorizes Complaints Against McDonald's Franchisees and Determines McDonald's, USA, LLC is a Joint Employer," National Labor Relations Board, July 29, 2014.

- ↑ Steven Greenhouse, "McDonald’s Ruling Could Open Door for Unions," New York Times, July 29, 2014.

- ↑ 36.0 36.1 Ernie Smith, "Trade Groups Denounce NLRB Ruling," Associations Now, July 30, 2014.

- ↑ Paul Frumkin, "NYC Lawmakers Consider Paid Sick Leave," Nation’s Restaurant News, September 15, 2009.

- ↑ Esmé E. Deprez, "Coughing Cooks Stay Home as U.S. Cities Require Paid Sick Leave," Bloomberg, Mar 21, 2013.

- ↑ National Restaurant Association, State and Local Paid Sick Leave Mandates, document obtained by CMD, accessed February 16, 2015.

- ↑ National Restaurant Association, "Cities and States Debate Paid Sick Leave," Press Release, June 25, 2013.

- ↑ 41.0 41.1 41.2 Brendan Fischer and Mary Bottari, "Efforts to Deliver "Kill Shot" to Paid Sick Leave Tied to ALEC," Center for Media and Democracy, PR Watch, April 3, 2013.

- ↑ American Legislative Exchange Council, "Labor and Business Regulation Subcommittee meeting agenda," organizational document, August 3, 2011, obtained and archived by CMD, accessed March 25, 2015.

- ↑ Alabama Retail Association, "Bill Bans Cities and Counties from Mandating Leave Time for Private Employees," Capitol Retail Report, April 19, 2013.

- ↑ Howard Fischer, "Arizona Bill Would Stop Cities from Imposing Employee Benefit Laws on Companies," East Valley Tribune, March 28, 2013.

- ↑ Arizona State Senate, "Minutes of Committee on Commerce, Energy and Military," governmental document, March 20, 2013.

- ↑ Paul Frumkin, "Sick Leave Spreads," Nation’s Restaurant News, October 10, 2011.

- ↑ Christopher Keating, "Paid Sick Leave Approved 28 - 24; Battle Lines Drawn Over Controversial Issue; Now Headed To Senate For Close Vote," Courant.com Capitol Watch, May 9, 2011.

- ↑ Ashley Lopez, "Florida Senate May Consider House’s More Restrictive Anti-Sick Pay Bill," Florida Center for Investigative Reporting, April 25, 2013.

- ↑ Indiana Chamber, "Bill Protects Indiana Business from Local Government Interference," Legislative Report, February 22, 2013.

- ↑ Kansas Restaurant & Hospitality Association, "Letter to Governor Brownback," April 11, 2013.

- ↑ American Legislative Exchange Council, "Labor and Business Regulation Subcommittee meeting agenda," organizational document, August 3, 2011, obtained and archived by CMD, accessed March 25, 2015.

- ↑ Michigan Restaurant Association, "Michigan Restaurant Association Commends House Committee for Passing Preemption Legislation," Press Release, March 13, 2013

- ↑ Michigan State Senate, ""Committee Meeting Minutes," Senate Committee on Reforms, Restructuring and Reinventing, March 28, 2013.

- ↑ Mississippi Legislature, "House Bill No. 141 (As Passed the House," Regular Session 2013.

- ↑ Project Vote Smart, "Representative Jerry R. Turner's Campaign Finances," accessed March 31, 2015.

- ↑ OpenStates.org, "S.B. 1023 Oklahoma Senate Bill," accessed March 31, 2015.

- ↑ Project Vote Smart, ""Senator Dan Newberry's Campaign Finances," accessed March 31, 2015.

- ↑ OpenStates.org, "H. 3941 South Carolina House Bill," accessed March 31, 2015.

- ↑ American Legislative Exchange Council, "Energy, Environment and Agriculture Task Force Meeting Agenda," October 27, 2010.

- ↑ American Legislative Exchange Council, "Telecommunications and Information Technology Task Force Meeting Agenda," July 18, 2011.

- ↑ Tennessee Hospitality Association, "TnHA News," March 20, 2013.

- ↑ Brian M. Rosenthal, ""Business groups take battle over Seattle sick-leave law to Olympia," The Seattle Times, February 18, 2013.

- ↑ Wisconsin Restaurant Association, "Wisconsin Act 16 Sick Leave Mandate Pre-emption Bill Signed into Law," organizational website, accessed March 31, 2015.

- ↑ National Restaurant Association, "New Restaurant Advocacy Fund Advances Industry’s Policy Interests," April 20, 2011.

- ↑ National Restaurant Association, "National Restaurant Association Unveils Restaurant Advocacy Fund to Play Key Role in Advancing Policy Interests of Restaurant Industry," April 13, 2011.

- ↑ NPR Staff, "For Tipped Workers, A Different Minimum Wage Battle," NPR, June 29, 2014.

- ↑ National Restaurant Association, "Tell Your Senators To Oppose A Minimum Wage Increase," organization website, accessed April 24, 2014.

- ↑ Oklahoma State Legislature, "S.B. 1023," legislative website, accessed April 23, 2014.

- ↑ M. Scott Carter, "News for March 4, 2014," Journal Record Legislative Report, March 4, 2014.

- ↑ Sunlight Foundation, "National Restaurant Assn," Influence Explorer, accessed February 28, 2014.

- ↑ Colorado State Legislature, "Ballot History: Amendment 42," governmental website, accessed March 31, 2015.

- ↑ National Institute on Money in State Politics, "Amendment 42: Increase in State's Minimum Wage," Follow the Money, accessed February 28, 2014.

- ↑ National Institute on Money in Politics, "Colorado Restaurant Association 2006," Follow the Money, accessed February 28, 2014.

- ↑ 74.0 74.1 74.2 Elections 2006: Key Ballot Measures, CNN, accessed April 7, 2015.

- ↑ National Institute on Money in State Politics, "No on 202 Opposed to I-13-2006," Followthemoney.org, accessed February 28, 2014.

- ↑ Arizona Legislature, "Ballot Proposition #202," accessed February 28, 2014.

- ↑ Arizona Secretary of State, "2006 General Election," accessed February 28, 2014.

- ↑ National Institute on Money in State Politics, "NO ON 202 OPPOSED TO I-13-2006 (FORMERLY JOBS FIRST AGAINST I-13-2006)," Follow the Money, accessed February 28, 2014.

- ↑ Sunlight Foundation, "National Restaurant Assn," Influence Explorer, accessed February 28, 2014.

- ↑ National Institute on Money in State Politics, "Issue 2: Increase in State's Minimum Wage," Follow the Money, accessed February 28, 2014.

- ↑ National Institute on Money in State Politics, "Ohioans to Protect Personal Privacy," Follow the Money, accessed February 28, 2014.

- ↑ Sunlight Foundation, "National Restaurant Assn," Influence Explorer, accessed February 28, 2014.

- ↑ Nevada Secretary of State, "Statewide Ballot Questions 2006," Nevada Legislature, accessed February 28, 2014.

- ↑ Sunlight Foundation, "National Restaurant Assn," Influence Explorer, accessed March 4, 2014.

- ↑ National Institute on Money in State Politics, "Proposition B: Increase in State's Minimum Wage," "Followthemoney.org", accessed March 4, 2014.

- ↑ National Institute on Money in State Politics, "Save Our States Jobs," Follow the Money, accessed March 4, 2014.

- ↑ Sunlight Foundation, "National Restaurant Assn," Influence Explorer, accessed March 4, 2014.

- ↑ National Institute on Money in State Politics, "I-151: Increase in State's Minimum Wage," "Followthemoney.org", accessed March 4, 2014.

- ↑ Sunlight Foundation, "National Restaurant Assn," Influence Explorer, accessed March 4, 2014.

- ↑ National Institute on Money in State Politics, "Coalition to Save Florida Jobs," Follow the Money, accessed March 4, 2014.

- ↑ National Restaurant Association, "Menu labeling - Overview," organizational website, archived by the Internet Archive Wayback Machine, accessed March 31, 2015.

- ↑ 92.0 92.1 92.2 Michele Simon, Appetite for Profit: How the Food Industry Undermines Our Health and How to Fight Back, (paperback) (Nation Books, 2006)

- ↑ ALECexposed.org, "DRAFT Food and Nutrition Act," organizational website, accessed March 31, 2015.

- ↑ National Restaurant Association Educational Foundation, "About Us," organizational website, accessed March 31, 2015.

- ↑ "National Restaurant Association And Nation's Restaurant News Announce Strategic Media Partnership," StarChefs.com, June 30, 2010.

- ↑ Elissa Elan, "Paid sick leave takes center stage in NYC," Nation's Restaurant News, November 17, 2009.

- ↑ Paul Frumkin, "Sick leave spreads," Nation's Restaurant News, October 10, 2011.

- ↑ Richard Berman, "“Minimum Wage Hikes Hurt Foodservice, Endanger Entry-Level Jobs," Nation's Restaurant News, December 6, 2010.

- ↑ Paul Frumkin, "Card-check bill spurs familiar fight," Nation's Restaurant News, March 23, 2009.

- ↑ Paul Frumkin, "Meet Dr. Evil," CBS News, September 19, 2007.

- ↑ Berman Exposed, "Who is Richard Berman?," organizational website, accessed March 31, 2015.

- ↑ Louis Jacobson, "Think Tanks on a Roll", National Journal, July 8, 1995, p. 1767.

- ↑ Employment Policies Institute, "Contact EPI," organizational website, accessed March 25, 2015.

- ↑ Berman and Company, "Contact Us," organizational website, accessed March 31, 2015.

- ↑ Robert S. Bressler, "Labor Department Clarifies That Employees Own Their Tips," Labor and Employment Law Weekly Update, April 18, 2011.

- ↑ National Restaurant Association, "DOL Changes Tip-Credit Regulations," May 5, 2011.

- ↑ Josh Eidelson, "Exclusive: Private documents reveal how Big Restaurant lobby monitors fast food protests," Salon, May 5, 2014.

- ↑ ROC United, "The National Restaurant Association: Behind the Fight Against Working Families and an Economy that Works for All," October 2011.

- ↑ ROC United, "The Other NRA," organizational website, April 28, 2014.

- ↑ National Restaurant Association, "National Restaurant Association Outlines Concerns With Passage of Health Care Bill In U.S. House," Press Release, March 21, 2010.

- ↑ Tom Boucher, "Statement on Behalf of the National Restaurant Association," U.S. House testimony, March 13, 2013.

- ↑ Tom Boucher, "Statement on Behalf of the National Restaurant Association," U.S. House testimony, March 13, 2013.

- ↑ Ernie Smith, "TRADE GROUPS BACK BILL TO END OBAMACARE AUTO-ENROLL PROVISION," Associations Now, July 23, 2014.

- ↑ Michael Grynbaum, "Health Panel Approves Restriction on Sale of Large Sugary Drinks," New York Times, September 14, 2012.

- ↑ National Restaurant Association, "NRA Says NYC Drinks Ban Is Confusion in a Cup," organizational press release, September 10, 2012.

- ↑ Joseph Ax, "Judge Blocks New York City Large-Soda Ban, Mayor Bloomberg Vows Fight," Reuters, March 11, 2013.

- ↑ Ron Ruggless, "High Court Refuses to Reinstate New York Big-Soda Ban," National Restaurant News, June 26, 2014.

- ↑ National Restaurant Association, "Dawn Sweeney," organizational website, accessed March 31, 2015.

- ↑ National Restaurant Association, "Senior Staff," organizational website, accessed March 31, 2015.

- ↑ "Marvin Irby," LinkedIn profile, accessed July 2013.

- ↑ National Restaurant Association, "Scott DeFife," organizational website, accessed July 2013.

- ↑ "Sue Hensely," LinkedIn profile, accessed July 2013.

- ↑ National Restaurant Association, "David Matthews", organizational website, accessed February 20, 2014.

- ↑ 124.0 124.1 Lawrence Mishel and Natalie Sabadish, "CEO pay and the top 1%," Economic Policy Institute, May 2, 2012.

- ↑ National Employment Law Project, "Super-Sizing Public Costs - How Low Wages at Top Fast-Food Chains Leave Taxpayers Footing the Bill," October 2013.

- ↑ Bureau of Labor Statistics, "May 2012 National Occupational Employment and Wage Estimates United States," United States Department of Labor, accessed April 7, 2015.

- ↑ Diane Stafford, "Research group criticizes taxpayer subsidy of restaurant industry," Kansas City Star, April 22, 2014, archived by Pharmacy Choice.

- ↑ National Employment Law Project, "Super-Sizing Public Costs - How Low Wages at Top Fast-Food Chains Leave Taxpayers Footing the Bill," organizational report, October 2013.

- ↑ Sarah Anderson and Betsy Wood, Institute for Policy Studies, "Restaurant Industry Pay: Taxpayers' Double Burden," organizational report, April 22, 2014.

- ↑ Bernie Becker, "Restaurant chains slash tax bill with executive pay deduction," The Hill, April 22, 2014.

- ↑ J V Dearlove, S A Bialous, and S A Glantz, "Tobacco industry manipulation of the hospitality industry to maintain smoking in public places," British Medical Journal, March 13, 2002.

- ↑ Americans for Nonsmokers Rights, "National Restaurant Assocation," organizational website, accessed July 2013.

- ↑ University of California-San Francisco, "National Restaurant Association," Legacy Tobacco Documents Library, accessed July 2013.

- ↑ Jonathan Martin, Maggie Haberman, Anna Palmer, and Kenneth Vogel, "Herman Cain Accused by Two Women of Inappropriate Behavior," Politico, October 31, 2011.

- ↑ 135.0 135.1 Holly Bailey, "Herman Cain's 'lavish' spending at National Restaurant Association drew scrutiny," Yahoo News, November 2, 2011.

- ↑ "Statement from National Restaurant Association on Herman Cain Sexual Harassment Accusations," Fox's News Insider, November 4, 2011.

- ↑ National Restaurant Association, "National Restaurant Association Members List," accessed March 31, 2015.