Pepco Holdings

{{#badges: CoalSwarm| Climate change | AEX}}Pepco Holdings, Inc. (PHI), or Potomac Electric Power Company, is a diversified energy company that, through its operating subsidiaries, is engaged primarily in two businesses:[1]

1. The distribution, transmission and default supply of electricity and the delivery and supply of natural gas (Power Delivery), conducted through the following regulated public utility companies:

- Potomac Electric Power Company (Pepco), which was incorporated in Washington, D.C. in 1896 and became a domestic Virginia corporation in 1949,

- Delmarva Power & Light Company (DPL), which was incorporated in Delaware in 1909 and became a domestic Virginia corporation in 1979, and

- Atlantic City Electric Company (ACE), which was incorporated in New Jersey in 1924.

2. Competitive energy generation, marketing and supply (Competitive Energy) conducted through subsidiaries of Conectiv Energy Holding Company (collectively Conectiv Energy) and Pepco Energy Services, Inc. and its subsidiaries (collectively Pepco Energy Services).

PHI was incorporated as a holding company in February 2001 for the purpose of effecting the acquisition of Conectiv Power Delivery. The acquisition was completed on August 1, 2002 at which time Pepco and Conectiv became wholly owned subsidiaries of PHI. Conectiv itself had been formed in 1998 to be the holding company of Delmarva Power & Light Company and Atlantic City Electric Company. In 2005, PHI resumed the use of the DPL and ACE entity names for purposes of operations, with the name Conectiv Energy restricted for PHI's energy production facilities.

Pepco is engaged in the transmission, distribution and default supply of electricity in Washington, D.C. and major portions of Prince George’s County and Montgomery County in suburban Maryland. Pepco’s service territory covers approximately 640 square miles and has a population of approximately 2.1 million. As of December 31, 2008, Pepco delivered electricity to 767,000 customers (of which 247,000 were located in the District of Columbia and 520,000 were located in Maryland).[1]

PHI ranked 254 on the 2009 Fortune 1000, a list of American companies ranked by gross revenue. Their revenues were $10.7 million. [2]

Contents

Ties to the American Legislative Exchange Council

has been a corporate funder of the American Legislative Exchange Council (ALEC). [3]

A list of ALEC Corporations can be found here.

| About ALEC |

|---|

ALEC is a corporate bill mill. It is not just a lobby or a front group; it is much more powerful than that. Through ALEC, corporations hand state legislators their wishlists to benefit their bottom line. Corporations fund almost all of ALEC's operations. They pay for a seat on ALEC task forces where corporate lobbyists and special interest reps vote with elected officials to approve “model” bills. Learn more at the Center for Media and Democracy's ALECexposed.org, and check out breaking news on our PRWatch.org site.

|

Existing Coal Plants

PHI subsidiary Conectiv Energy has 19 electric generating stations. Most run on gas, but the following run on coal:[4]

| Plant Name | State | Year(s) Built | Capacity |

|---|---|---|---|

| Deepwater Generating Station | CO | 1958 | 82 MW |

| Edge Moor Power Plant | DE | 1954, 1966 | 252 MW |

Tax breaks and subsidies

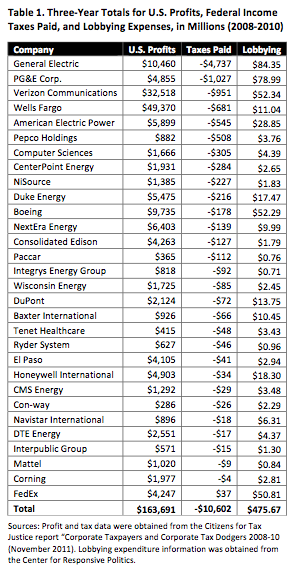

A 2011 analysis by Citizens for Tax Justice and the Institute on Taxation and Economic Policy, "Corporate Taxpayers & Corporate Tax Dodgers: 2008-10" found dozens of companies, including fossil fuels, used tax breaks and various tax dodging methods to have a negative tax balance between 2008 and 2010, while making billions in profits. The study found 32 companies in the fossil-fuel industry -- such as Peabody Energy, ConEd, and PG&E -- transformed a tax responsibility of $17.3 billion on $49.4 billion in pretax profits into a tax benefit of $6.5 billion, for a net gain of $24 billion.[5]

Pepco had the highest negative tax rate of the 280 companies surveyed in the 2011 report, with negative taxes of $508 million on $882 million pretax profits, a negative tax rate of 57 percent.[6]

In December 2011, the organization Public Campaign published a report called "For Hire: Lobbyists or the 99%?" on corporations that have paid more on lobbying than on federal taxes. Pepco ranked sixth (see chart).[7] From 2008 to 2010, Pepco owed $816 million in federal taxes but had tax subsidies of $816.7 million (with two subsidiaries in tax havens), so that the company claimed $508 million from the U.S. Treasury, while spending $3.8 million over the same period lobbying.[8]

Contact details

Pepco Holdings, Inc.

701 Ninth Street N.W.

Washington, DC 20068

Phone: (202) 872-2000

Website: http://www.pepcoholdings.com/

Article and resources

References

- ↑ 1.0 1.1 "Pepco Holdings 2008 10K Report" Edgar Online, Filed March 2, 2009.

- ↑ "Fortune 500" CNNMoney.com, accessed September 2009

- ↑ Defenders of Wildlife, Natural Resources Defense Council, "Corporations and Trades Associations that Fund ALEC," Corporate America's Trojan Horse in the States: The Untold Story Behind the American Legislative Exchange Council, online report, 2003

- ↑ "Conectiv Energy Generating Stations" Conectiv Energy Website, August 2009.

- ↑ Brad Johnson, "Corporate Welfare For Energy Companies Means We Paid $24 Billion In Taxes To Them," Think Progress, Nov. 7, 2011.

- ↑ Robert S. McIntyre, Matthew Gardner, Rebecca J. Wilkins, Richard Phillips, "Corporate Taxpayers & Corporate Tax Dodgers: 2008-10" Citizens for Tax Justice and the Institute on Taxation and Economic Policy, November 2011 Report.

- ↑ Public Campaign, For Hire: Lobbyists or the 99%? How Corporations Pay More for Lobbyists Than in Taxes, organizational report, December 2011

- ↑ Public Interest Research Group and Citizens for Tax Justice, "Representation Without Taxation: Fortune 500 Companies that Spend Big on Lobbying and Avoid Taxes," Public Interest Research Group and Citizens for Tax Justice, January 2012 Report

Related SourceWatch Articles

- Existing U.S. Coal Plants

- Delaware and coal

- District of Columbia and coal

- Maryland and coal

- New Jersey and coal

- United States and coal

- Global warming

External resources

Wikipedia also has an article on Pepco Holdings. This article may use content from the Wikipedia article under the terms of the GFDL.