Portal:Fix the Debt

Fix the Debt Astroturf Supergroup

"Grand Bargain" Means Cuts to Social Security and Medicare

Fix the Debt’s Last Harrumph

The Campaign to Fix the Debt – billionaire Pete Peterson’s Wall Street-backed austerity front group – is scaling down and shedding staff after failing to achieve any of their toxic goals.Their fake youth group, “The Can Kicks Back,” is in debt and about to kick the bucket. They are packing up their phony “can man” and their Mercedes BMW tour mobile (bizarrely called the AmeriVAN) and putting Simpson-Bowles in mothballs. Read our piece on how astroturf got mowed by real people.

Since our February 2013 front page expose on this “astroturf supergroup” in the Nation, you helped us spread the word and call out the tax dodging hypocrites with platinum plated pensions pushing harmful budget cuts. Fix the Debt failed because Americans aren’t interested in cutting Social Security or Medicare to offset more tax handouts to big corporations.

Now we learn that President Obama has struck “chained CPI” Social Security cuts from his budget proposal. It is time to take advantage of this important victory to pivot to a discussion on how to improve and strengthen these lifesaving programs to preserve them for future generations.

Please consider a generous donation today.

Dear WWII Vets, Forget About the Monument, They Are Gunning for Your Social Security!

This led to absurd images of Republicans -- who had shut down the federal government, including all monuments and museums -- rushing to "aid" veterans shut out by monument closures. In the most revolting display, Rep. Randy Neugebauer (R-CA) publicly berated a National Park Service Ranger for a situation created entirely by Congress.

As the government shutdown marches on and the dangerously real deadline of the federal debt limit approaches, it is increasingly clear that the fight over "Obamacare" is merely an opening salvo. The real goal of the hostage takers is a "Grand Bargain" on the budget that would include cuts to Social Security and Medicare.

This has been the long-term agenda for debt crisis-monger Pete Peterson and government haters David and Charles Koch for many decades. But now, after massively gerrymandering the electoral landscape in 2010, these manufactured crisis kings and backstage billionaires hold all the cards.

Rev up those engines. It's time for the Honor Vets to head back to Washington to save us all.

Read the full article on PRWatch here.

New Heights of Hypocrisy in Latest "Fix the Debt" Ad

Today, the group launched a six figure TV ad buy that reaches new heights of hypocrisy -- and that is saying a lot.Former U.S. Senator Alan Simpson and Morgan Stanley board member Erskine Bowles have long been spokespersons for Fix the Debt. The "folksy" Simpson: "For cryin' out loud, Erskine, who isn't fed up with what's goin' on in Washington?" The Bowles tsk tsk: “These politicians are playing games jerking our country around from crisis to crisis.”

This is rich from a group that has been hyping a debt and deficit crisis since its launch in July 2012, even though the deficit has been cut in half in recent years. In January 2013 Fix the Debt steering committee member and former Tennessee Governor Phil Bredesen admitted that Fix the Debt's strategy was to create an "artificial crisis" to achieve a "grand bargain" on Medicare and Social Security.

Moreover, Fix the Debt was started with a $5 million donation from crisis king Pete Peterson. Peterson has been warning that our Social Security would create a “Pearl Harbor” type crisis for decades as my colleague Lisa Graves documented in her Nation piece “Long History of Deficit Scaremongering.”

Read the full article on PRWatch here.

Wall Street Billionaire Pete Peterson

Move over, David Koch and George Soros! Pete Peterson is "the most influential billionaire in America," says the LA Times.

Peter G. Peterson has long used his wealth to underwrite numerous organizations and PR campaigns to generate public support for slashing Social Security and Medicare, citing concerns over "unsustainable" federal budget deficits. Full of apocalyptic warnings, Peterson failed to warn of the $8 trillion housing bubble, but conveniently sold his private equity firm Blackstone Group on the eve of the financial crisis. He later pledged to spend $1 billion of the money from the sale to "fix America's key fiscal-sustainability problems," launching the Peter G. Peterson Foundation in 2008.[2] As of 2011, the Huffington Post reported that Peterson had personally given $458 million to the Foundation.[3]

Peterson told the Washington Post that he gave Fix the Debt $5 million in funding;[4] Fix the Debt was announced on the Peterson Foundation website[5] and Peterson appeared at the Fix the Debt launch in July 2012.[6] Peterson also funds Fix the Debt parent organization Committee for a Responsible Federal Budget at the New America Foundation. Even before the 2012 Campaign to Fix the Debt, Peterson poured millions into a multifaceted effort to support the Simpson-Bowles Commission and its $4 trillion austerity package, a plan that would cost the nation four million jobs, according to the Economic Policy Institute,[7] and "destroy Social Security as we know it," according to Social Security Works.[8] He bankrolled nineteen "America Speaks" Town Hall meetings, which spectacularly backfired, launched the "OweNo" TV ad campaign, and funded the Concord Coalition’s Fiscal Solutions tour to take the message to the heartland. When the commission blew up -- failing to get the votes needed to advance a plan to Congress -- Peterson gave Bowles and Simpson a new perch at the Committee for a Responsible Federal Budget to allow them to continue to scold Congress. Learn more about Pete Peterson in "Peterson's Long History of Deficit Scaremongering" in The Nation.

AFL-CIO Says It Will "Fight to the Death" to Stop Cuts and Will Give "No Cover" to Democrats

- “The labor movement is going to fight to the death to stop cuts to Social Security and Medicare and Medicaid,” AFL-CIO policy director Damon Silvers told Salon Thursday afternoon. “Not ‘unreasonable cuts.’ Not ‘cuts without tax increases.’ Cuts period. We’re against all of them, we will fight them ferociously, and we will give no cover to any Democrat who supports them.”

- Silvers said it would be “simply an invitation to a fratricide in the Democratic Party” for the president to take up a renewed push for “chained CPI,” a proposed change in cost of living calculations that would reduce future Social Security benefits. “It hits the absolute most vulnerable people …” charged Silvers. “It’s a proposal that has no merit at all other than that billionaires like it.”

- He also called out billionaire Pete Peterson, who funds several groups advocating for cuts. “They’ve got the vampire agenda: No matter what happens, no matter how many bullets you fire at it, these guys keep coming back with all their money and demanding that we cut Social Security and Medicare and Medicaid …” said Silvers. “We’re gonna fight that stuff with everything we’ve got, and we’re gonna win, because the public’s with us.”

Fix The Debt Hypocrites Want to Exempt Off-Shore Earnings From U.S. Taxation

The Fix the Debt campaign is a heavily funded corporate lobby group pushing for cuts to Social Security and Medicare and more corporate tax breaks. One of their main goals is a “territorial” tax system that would permanently exempt U.S. corporations’ foreign earnings from U.S. federal income taxes. Erskine Bowles and Alan Simpson, who serve as Fix the Debt Co-Founders, also made this reform a centerpiece of their recently released deficit reduction proposal. The IPS report provides updated figures based on recently released 2012 tax data. Major findings include:

- Two-thirds of the 93 publicly held corporations involved with Fix the Debt were holding profits in offshore subsidiaries at the end of 2012. The 59 firms that reported the amount of these offshore profits had a combined total of more than $544 billion, up from $473 billion in 2011. The average offshore stash per company rose 15 percent in 2012 to $9.4 billion. Currently, these profits are not subject to U.S. corporate income taxes unless they are brought back to the United States (also known as repatriation).

- If Congress adopts Fix the Debt’s proposed territorial tax system, these 59 companies would stand to win as much as $173 billion in immediate tax windfalls. The biggest potential winner is General Electric, which could reap a tax windfall of as much as $38 billion on its overseas earnings stash of $108 billion.

Pete Peterson Linked Economists Caught in Austerity Error

A team of economists at the Political Economy Research Institute (PERI) at UMass Amherst broke a huge story this week that was promptly picked up by the New York Times, the Washington Post, the Financial Times, and newspapers around the globe. The economists proved that the essential underpinning "of the intellectual edifice of austerity economics," as Paul Krugman put it, is based on sloppy methodology and spreadsheet coding errors.

Three years ago, Harvard economists Carmen Reinhart and Kenneth Rogoff released a study that presented empirical evidence from 44 nations over a 200 year time span to demonstrate that countries with a public debt over 90 percent of GDP (the United States is at about 100 percent, Japan at 200 percent) have average growth rates one percent lower than other nations.

Forty-four countries, 200 years, Harvard -- pretty convincing, huh?

Except it was wrong.

It will come as no surprise that Reinhart and Rogoff have ties to Wall Street billionaire Pete Peterson, a big fan of their work. Peterson has been advocating cuts to Social Security and Medicare for decades in order to prevent a debt crisis he warns will spike interest rates and collapse the economy. (Peterson failed to warn of the actual crisis building on Wall Street during his time at the Blackstone Group.)

Key Findings & Useful Charts

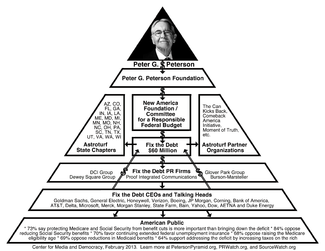

Astroturf Supergroup

With 127 CEOs able to schedule meetings with President Obama and Congressional leaders, numerous PR firms lending a hand,[9] 80 staff,[10] multiple Peterson funded "partner" groups, and 23 phony state chapters, this incarnation of the Peterson message machine must be taken seriously. Fix the Debt documents say the group is targeting a budget of $60 million for the "first phase," [11] but in February 2013 Fix the Debt's spokesperson told CMD the organization had only raised $40 million so far. Fix the Debt engaged in a multi-million dollar paid ad campaign in the run-up to the so-called "fiscal cliff" and now is taking that campaign outside the beltway, which is "increasingly resembling a presidential race with grassroots style organizing and offices in places like New Hampshire and Ohio," writes Fortune magazine.[10] As of February 2013, group was touting it 345,000 members/petition signatures. That sounds impressive until one learns that a number of CEOs, such as the CEO of Caterpillar Inc., wrote to 130,000 employees encouraging them to sign [12]and one recalls that their goal was 10 million.[13]Learn more about the firms and the stunts behind the PR spin in the article "Pete Peterson's Puppet Populists" and the Fix the Debt Partners page.

Undisclosed Conflicts of Interest

Fix the Debt biographies fail to reveal that their core leadership team is riddled with conflicts of interest. Public Accountability Initiative (PAI) points to at least 13 steering committee members with financial ties to firms that lobby on deficit-related matters that are not disclosed in their glossy Fix the Debt bios. These firms lobby to preserve dozens of costly tax breaks (including the “carried interest” tax loophole that made Pete Peterson a rich man) or to hold off new taxes, such as the “Robin Hood Tax,” a proposed financial speculation tax that could raise as much as a $1 trillion over 10 years.[14] Click here to see a chart of these conflicts of interest and tax lobbying records.

Prominent CEOs Fail to Fully Fund Employee Pension Plans

While Fix the Debt’s 127 CEOs call for cuts to Social Security (a program that does not contribute to the deficit since it is has a surplus and is accounted for outside the federal budget), many of the publicly-traded Fix the Debt firms underfund their employee pension plans by some $103 billion making their employees even more dependent on Social Security.[15] The CEOs, of course, enjoy lavish retirement packages, averaging $9 million each, according to a study by the Institute for Policy Studies.[16] Click here to see a chart of CEO retirement assets vs. underfunded employee pensions (PDF).

The Real Corporate Tax Loophole Agenda

Many Fix the Debt firms pay a negative tax rate, which contributes greatly to the federal deficit. Worse, Fix the Debt firms are pushing for a "globally competitive" territorial tax system that would increase the debt by $1 trillion over ten years and encourage the offshoring of U.S. jobs, according to Citizens for Tax Justice.[14] This tax cut is not listed in their online goals and rarely spoken of explicitly, but it is mentioned on a slideshow buried on the group's website. The switch would not only add to the deficit, it results in a windfall of some $134 billion dollars for at least 63 Fix the Debt firms, including Google and GE, according to a report by the Institute for Policy Studies.[17] Click here to see a table of 10 top winners from a territorial tax system (PDF).

Many of the Firms Are Federal Defense Contractors

While Fix the Debt targets government programs for the middle class, 38 Fix the Debt leaders are tied to companies with defense contracts totaling $43.4 billion in 2012, as PAI has documented.[18] Boeing (with $25.1 billion in defense contracts) and Northrop Grumman (with $8.5 billion) lead the pack. Boeing CEO W. James McNerney, Jr. is on Fix the Debt’s CEO Council, and Northrop Grumman board member Vic Fazio is on Fix the Debt’s steering committee. Click here to see a chart of the top six defense contractors with Fix the Debt ties (PDF).

Fix the Debt Leaders & Conflicts of Interest

Fix the Debt biographies consistently fail to expose the financial and lobbying ties of Fix the Debt leaders. You can see a chart of undisclosed financial interests by clicking here or visit our Fix the Debt Leaders page for more detail.

Fix the Debt Leader Maya MacGuiness Once Promoted the Privatization of Social Security

Maya MacGuineas spearheads the Fix the Debt campaign. She is the president of Fix the Debt's parent organization, the Committee for a Responsible Federal Budget, which is a project of the Peterson-funded New America Foundation (NAF). MacGuineas was dubbed "queen of the deficit scolds" by economist Paul Krugman[19] Although it is not disclosed on her Fix the Debt bio, she has long advocated for the privatization of Social Security (see 2001 testimony.)[20]UNDISCLOSED CONFLICT OF INTEREST: MacGuineas' husband Robin Brooks is a managing director and a currency trading analyst at Goldman Sachs.[21] Goldman Sachs lobbies around federal tax issues affecting banking and securities and is a member of the Managed Funds Association, which lobbies against efforts to make Wall Street pay its fair share such as the proposed "Robin Hood Tax," a a tiny tax on trades that some economists project could raise $1 trillion over 10 years.[22][23]

Oops, Phil Bredesen Reveals "Artificial Crisis" Strategy

Phil Bredesen is the former Democratic Governor of Tennessee and was a superdelegate in the 2008 Democratic presidential nomination. He is a former healthcare industry executive (he founded HealthAmerica Corporation, an insurance company, which he sold in 1986 for about $385 million), and is currently on the board of directors of Vanguard Health Systems,[24] a $5 billion hospital chain, receiving an annual compensation of $240,005 in 2011.[25]Bredesen is on the steering committee of the Campaign to Fix the Debt.[26] In January 2013, Bredesen admitted that Fix the Debt's strategy was to create an "artificial crisis" to achieve a "grand bargain" on Medicare and Social Security.[27]

UNDISCLOSED CONFLICT OF INTEREST:Bredesen is currently on the board of directors of Vanguard Health Systems,[28] a $5 billion hospital chain, receiving an annual compensation of $240,005 in 2011.[29] Vanguard lobbied on federal appropriations issues in the third quarter of 2012.[30] Vanguard's biggest owner is the private equity firm Blackstone Group[31] (Blackstone and its affiliates acquired Vanguard in 2004).[32] Blackstone was co-founded by Fix the Debt funder Pete Peterson.[33] Bredesen has been an investor in a number of healthcare companies in addition to HealthAmerica Corp., including Coventry Health Care (which was recently sold to Aetna for $5.6 billion)[34], First Commonwealth, and Qualifacts Systems Inc. For a time Bredesen was being considered for Health and Human Services secretary in the first Obama administration, but lost out to Kathleen Sebelius. Responding to opposition to his potential appointment from national and Tennessee healthcare advocates, Bredesen told the Wall Street Journal[35] "advocacy groups don't matter nearly as much as the pharmaceutical groups, the hospitals, the doctors' groups. There's a lot of very powerful interest groups that will play in this thing." Bredesen is on the Governor's Council of the Bipartisan Policy Center, which received $400,000 from the Peter G. Peterson Foundation in 2011 to fund its Debt Reduction Task Force.[36]

"Grand Bargain" Hoax

In honor of Peterson's many decades of work hyping a nonexistent deficit crisis and neglecting to warn America about real issues, CMD is releasing its own short movie on Peterson and crew along with Pulitzer Prize winning cartoonist Mark Fiore.

Democracy Now!

CMD's Lisa Graves and John Nichols of The Nation speak with Democracy Now! about Pete Peterson's astroturf supergroup "Fix the Debt."

Featured Articles

- Michael Hiltzik, This billionaire is still trying to make you panic about federal debt, L.A. Times, July 29, 2014.

- Mary Bottari, Dear WWII Vets, Forget About the Monument, They Are Gunning for Your Social Security, PRWatch, October 9, 2013.

- Sarah Anderson, Scott Klinger, Javier Rojo, Corporate Pirates of the Caribbean, The Institute for Policy Studies, June 12, 2013 .

- PRWatch.org, Pete Peterson’s “Fix the Debt” Astroturf Supergroup Detailed in New Online Resource from the Publishers of ALECexposed.org, February 21, 2013.

- Lisa Graves, Pete Peterson's Chorus of Calamity, PRWatch, February 21, 2013.

- John Nichols, The Austerity Agenda: An Electoral Loser, The Nation, February 21, 2013.

- Dean Baker, Fix the Debt's Fuzzy Math, The Nation, February 21, 2013.

- Mary Bottari, Peterson's Puppet Populists, PRWatch, February 21, 2013.

- The Nation Editorial Board, Stacking the Deck: The Phony 'Fix the Debt' Campaign, The Nation, February 21, 2013.

- Lisa Graves, Conversation with "Fix the Debt," Help Count the Pinocchios, PRWatch.org, February 28, 2013.

- Mary Bottari, Guess Who's Coming to Dinner? Fix the Debt, PRWatch.org, February 28, 2013.

- Fix the Debt's Leadership

- Fix the Debt Leaders' Conflicts of Interest

- Fix the Debt's Partner Groups

- Fix the Debt's State Chapters

- Fix the Debt's Lobbyists

- Fix the Debt's Parent Group

- Fix the Debt's Corporations

- Pete Peterson

- Peter G. Peterson Foundation

- Social Security

- Medicare

Recent Press

- The New York Times, Jared Bernstein and Dean Baker, Taking Aim at the Wrong Deficit, November 6, 2013.

- Los Angeles Times, Michael Hiltzik, Another completely bogus poll on the national debt, October 29, 2013.

- Slate, Matthew Yglesias, Fix The Debt Applauds Hostage Tactics, October 7, 2013.

- LA Times, Michael Hiltzik, The chained CPI: A zombie benefit cut still walks, October 4, 2013.

- New York Magazine, Kevin Roose, Why Doesn’t Fix the Debt Try to Do Something About the Debt Ceiling?, October 3, 2013.

- Los Angeles Times, Michael Hiltzik, False equivalency from Fix the Debt, October 2, 2013.

- National Journal, Chris Frates, Fiscal Fights Looming, Can Simpson-Bowles Group Get Congress to Move?, August 27, 2013.

- Nonprofit Quarterly , Rick Cohen, Pay No Corporate Taxes: GE and Other Corporations Line Up Behind “Fix the Debt”, August 26, 2013.

- Other Words, Scott Klinger, It’s Time Corporations Flew Old Glory Instead of the Jolly Roger, June 12, 2013.

- Morning Sentinel, Sarah Anderson, Taxpayers subsidize CEO salaries with 'performance pay' loophole, May 19, 2013.

- Huffington Post, Michele Swenson, Pete Peterson's Fix the Debt CEOs Promote Austerity for the Masses, Expanding Wealth for the 1 Percent, May 21, 2013.

- The Dalles Chronicle, Sam Pizzigati, How We Pay For Ceo ‘Performance’, May 14, 2013.

- Teamster Nation, Meet the greedy billionaire who wants to destroy Social Security, April 8, 2013.

- Democracy Now!, Billionaires for Austerity: With Cuts Looming, Wall Street Roots of "Fix the Debt" Campaign Exposed, February 26, 2013.

- New York Times, Thomas Edsall, The War on Entitlements, March 6, 2103.

- Bloomberg Businessweek, Joshua Green, Why Won't Americans Listen to Alan Simpson and Erskine Bowles, February 28, 2013.

- Huffington Post, Dean Baker, Macho Men, Social Security, and Chained CPI, February 25, 2013.

- Washington Post, Ezra Klein, The Problem with Alan Simpson, "Wonkblog," February 20, 2013.

The Pyramid Scheme

Join the Conversation

Wall Street Welcomes Fix the Debt

The Can Kicks Back

Peterson-Funded Fix the Debt Partner Groups

Pete Peterson has given at least $5 million to Fix the Debt, according to the Washington Post.[38] Fix the Debt is listed as a project of the Committee for a Responsible Federal Budget (CRFB) on CRFB's website. Peterson has long funded CRFB and served on its board.[39] CRFB is itself a project of the New America Foundation (NAF). In the 1990s, CRFB partnered with tobacco firms, anxious to avoid higher excise taxes on cigarettes, to tank the Clinton health care plan.[40] Today, critics claim CRFB is a "Trojan Horse" for a similar agenda to cut taxes for wealthy corporations who want to create a territorial tax system.[41]

The Peter G. Peterson Foundation funds at least six of the "partner" organizations listed on Fix the Debt's website:

- Committee for a Responsible Federal Budget/New America Foundation: $2,050,000,[42]

- The Moment of Truth Project: $300,000 (another project of CRFB),[42]

- Comeback America Initiative: $3,100,000,[43]

- Committee for Economic Development: $1,853,616,[44] and

- Concord Coalition: $6,036,060 (including $1,500,000 in matching funds).[45]

With regard to Fix the Debt and its many partner organizations, the National Journal observed: "Singlehandedly, Peterson has created a loose network of deficit hawk organizations that seem independent but that all spout the Peterson-sanctioned message of a 'grand bargain.'"[46]

Fix the Debt Firms: Unpaid Taxes and Underfunded Pensions

Fix the Debt CEOs say they are worried about the debt and deficits, yet many Fix the Debt firms pay a negative tax rate or a tax rate well below the standard 35 percent -- adding greatly to our nation’s deficit. Fix the Debt CEOs say that what is needed to balance the books is cuts to earned benefit programs like Social Security (which is a separate federal program not counted in the federal budget at all). At the same time, many of these same CEOs under-fund their employee pension plans, making it likely that their workers will be even more dependent on Social Security. This hypocrisy has led to a campaign called "Flip the Debt," which calls upon major corporations to pay their fair share of taxes.

Fix the Debt Articles

- Fix the Debt's Leadership (table)

- Fix the Debt's Partner Groups

- Fix the Debt's State Chapters

- Fix the Debt's Lobbyists

- Fix the Debt's PR Firms

- Fix the Debt's Parent Group

- Fix the Debt's Corporations

- ACE Limited

- Advance America, Cash Advance Centers, Inc.

- Aetna

- Air Products and Chemicals

- Airlines for America

- Alcoa

- Alliance for Business Leaders

- Allstate Corporation

- American International Group, Inc

- AmericanTowns.com

- Apollo Global Management

- Ashford Hospitality Trust

- Associated Partners, LP

- AT&T

- Atlas Air Worldwide Holdings, Inc.

- Bain Capital

- Bank of America

- Belk, Inc.

- BlackRock

- Boeing

- Boston Capital

- Bridgestone Americas, Inc.

- Broadridge Financial Solutions

- CA Technologies

- Caesars Entertainment

- Calix

- CapWealth Advisors LLC

- The Carlyle Group LP

- Case New Holland, Inc.

- Caterpillar

- CCMP Capital Advisors, LLC

- Cisco Systems

- Citigroup, Inc.

- Clayton, Dubilier & Rice, LLC

- Committee for Economic Development

- Continental Grain Company

- Cooper Industries PLC

- Corning

- Corporate Executive Board Co.

- Court Square Capital Partners

- Covington & Burling LLP

- Cravath, Swaine & Moore, LLP

- CSX

- CVS Caremark Corporation

- Daintree Advisors

- Deere & Co

- Delaware Street Capital, LLC

- Deloitte LLP

- Delta Air Lines

- Deutsche Bank Americas Holding Corporation

- DIRECTV

- Discovery Communications, Inc.

- Dow Chemical

- Duke Energy Corporation

- Eagle Capital Management, LLC

- EarthLink

- eBay, Inc.

- Eaton

- Eloqua

- EMC Corporation

- Entravision Communications Corporation

- Equifax, Inc.

- Express Scripts

- Farallon Capital Mgmt. LLC

- FedBid, Inc.

- First National Bank of Fort Smith

- Foot Locker

- General Atlantic, LLC

- General Electric

- Goldman Sachs

- Greycroft Partners

- Guggenheim Partners, LLC

- HarbourVest Partners, LLC

- Honeywell

- Humana

- IAC/InterActiveCorp

- Ingersoll-Rand PLC

- Ingram Content Group, Inc.

- Interaction Associates

- nvesco

- Investment Technology Group

- J.P. Morgan

- Jet Blue

- JP Morgan Chase

- Kelly Services, Inc.

- Knight Capital Group

- Loews Corp

- M&T Bank

- Macy’s

- Manhattan Pacific Partners

- Marriott International

- Marsh & McLennan

- Maverick Capital Ltd

- McKinsey & Company

- Merck

- MFS Investment Management

- Michelin North America, Inc.

- Microsoft Corporation

- Montgomery & Co.

- Morgan Stanley

- Motorola Solutions

- NASDAQ OMX Group

- Norfolk Southern Corporation

- NYSE Euronext

- Partnership for New York City

- Passport Capital, LLC

- Peregrine Group

- Pershing Square Capital Management LP

- Pricewaterhouse Coopers LLP

- Prologis

- Promontory Financial Group

- Providence Equity Partners LLC

- Qualcomm

- R.R. Donnelley & Sons

- Ramsey Asset Management

- Reputation.com

- Riverside Partners, LLC

- RRE Investors, LLC

- Rudin Management Company, Inc.

- Silicon Valley Leadership Group

- Silver Lake Partners

- Sirius XM Radio

- Stanley Black & Decker

- Staples, Inc.

- Starwood Hotels and Resorts

- State Farm

- Staton Financial Advisors, LLC

- SunGard Data Systems, Inc.

- T. Rowe Price

- Tenneco

- Terex Corporation

- Textron

- The AES Corporation

- The Bank of New York Mellon Corporation

- The Duchossois Group, Inc.

- The Goldman Sachs Group, Inc.

- The Graham Group

- The Hillman Company

- Thermo Fisher Scientific

- Three Ocean Partners LLC

- Time Warner Cable

- Tishman Speyer

- TiVo

- United Parcel Service

- UnitedHealth Group

- VeriFone

- Verizon Communications, Inc.

- Vornado Realty Trust

- Weber Shandwick Worldwide

- Welsh Carson Anderson & Stowe

- Weyerhaeuser

- Wheels, Inc.

- Willis Group Holdings PLC

- W.L. Ross & Co., LLC

- World Fuel Services

- Wunderman

- Yahoo! Inc.

- Pete Peterson

- Peter G. Peterson Foundation

- America Speaks

- Simpson-Bowles Commission

- Social Security

- Medicare

- Medicaid

References

- ↑ Campaign to Fix the Debt, CEO Talking Points 10/2/12, organizational document, October 2, 2012.

- ↑ Peter G. Peterson, Why I’m Giving Away $1 Billion, The Daily Beast, May 29, 2009.

- ↑ Ryan Grim and Paul Blumenthal, Peter Peterson Spent Nearly Half A Billion In Washington Targeting Social Security, Medicare, Huffington Post, May 15, 2012.

- ↑ Suzy Khimm, How Fix the Debt is coping with its 'fiscal cliff' setback, Washington Post, January 11, 2013.

- ↑ Peter G. Peterson Foundation, Civic Leaders, CEOs and Budget Experts Gather to Announce Launch of The Campaign to Fix the Debt, organizational website under "Projects and Grants," July 17, 2012.

- ↑ New America Foundation, Launch of the Fix the Debt Campaign: July 17th, 2012 - National Press Club, youtube page, July 19, 2012.

- ↑ Josh Bivens and Andrew Fieldhouse, Fiscal commissioners' proposal would cost millions of jobs, Economic Policy Institute, November 16, 2010.

- ↑ Social Security Works, No Drastic Changes to Social Security, The Olympian op-ed, September 25, 2009.

- ↑ Virgil Dickson, "Burson's Proof unit launches Fix the Debt ad campaign", PR Week, November 16, 2012.

- ↑ 10.0 10.1 Anne VanderMey, "Fix the Debt isn't going anywhere", Fortune, January 30, 2012.

- ↑ Campaign to Fix the Debt, CEO Talking Points 10/2/12, organizational document, October 2, 2012.

- ↑ Carol E. Lee, "Morgan Stanley CEO Asks Employees to Press Congress on Fiscal Cliff", Washington Wire, November 27, 2012

- ↑ Amy Bingham, "The Fiscal Cliff: Congress’ Imminent Armageddon", OTUS, Jul 17, 2012

- ↑ 14.0 14.1 Citizens for Tax Justice, Why Congress Should Reject A “Territorial” System and a “Repatriation” Amnesty: Both Proposals Would Remove Taxes on Corporations’ Offshore Profits, fact sheet, October 19, 2011.

- ↑ Institute for Policy Studies, A Pension Deficit Disorder: The Massive CEO Retirement Funds and Underfunded Worker Pensions at Firms Pushing Social Security Cuts, organizational report, November 21, 2013.

- ↑ Institute for Policy Studies, A Pension Deficit Disorder: The Massive CEO Retirement Funds and Underfunded Worker Pensions at Firms Pushing Social Security Cuts, organizational report, November 21, 2013.

- ↑ Institute for Policy Studies, The CEO Campaign to ‘Fix’ the Debt: A Trojan Horse for Massive Corporate Tax Breaks, organizational report, November 13, 2013.

- ↑ Public Accountability Initiative, Operation Fiscal Bluff, organizational report, December 19, 2012.

- ↑ Paul Krugman, Maya and the Vigilantes, New York Times, December 22, 2012.

- ↑ New America Foundation, Testimony of Maya MacGuineas, organizational document, testimony from the President's Commission to Strengthen Social Security on October 18, 2001.

- ↑ Susanne Craig, Goldman Names Managing Directors, New York Times, November 18, 2011.

- ↑ American Bankers Association, Lobbying Report, trade association lobbying report with U.S. Congress, July 1 - September 30, 2012.

- ↑ Managed Funds Association, Lobbying Report, trade association lobbying report with U.S. Congress, July 1 - September 30, 2012.

- ↑ Vanguard Health Systems, "Bredesen Biography", organizational website, accessed January 1, 2013.

- ↑ Vanguard Health Systems, Inc., Schedule 14A Proxy Statement, corporate Securities and Exchange Commission filing, October 19, 2012, p. 55.

- ↑ Fix the Debt, CEO Fiscal Leadership Council, organizational document, accessed January 2013.

- ↑ Chas Sisk, Gov. Phil Bredesen Calls for 'Artificial Crisis' on the Debt, Tenneseean, January 29, 2013.

- ↑ Vanguard Health Systems, "Bredesen Biography", organizational website, accessed January 1, 2013.

- ↑ Vanguard Health Systems, Inc., Schedule 14A Proxy Statement, corporate Securities and Exchange Commission filing, October 19, 2012, p. 55.

- ↑ Capitol Health Group, LLC, Lobbying Report, lobbying firm lobbying report filed with U.S. Congress on client Vanguard Health Systems, July 1 - September 30, 2012.

- ↑ Vanguard Health Systems, Inc. Major Holders, Yahoo! Finance, accessed January 2013.

- ↑ #109 Vanguard Health Systems, "America's Largest Private Companies," Forbes, 2010.

- ↑ Peter G. Peterson Foundation, Peter G. Peterson, Founder and Chairman, organizational website, accessed January 2013.

- ↑ Kevin Rector, "Coventry Health Care To Pay $3 Million To Avoid Prosecution in Medicare Case", The Hartford Courant, November 21, 2012.

- ↑ Laura Meckler, HHS Candidate Draws Fire, Fights Back", The Wall Street Journal, February 10, 2009.

- ↑ Peter G. Peterson Foundation, "Bipartisan Policy Center, Inc.", organizational website, accessed January 1, 2013.

- ↑ Paul Blumenthal and Christina Wilkie, Fix The Debt Campaign's Bipartisan Veneer Masks Conservative Backing, Huffington Post, December 3, 2012.

- ↑ Suzy Khimm, How Fix the Debt is coping with its ‘fiscal cliff’ setback, Washington Post Wonkblog, January 11, 2013.

- ↑ Committee for a Responsible Federal Budget, CRFB, organizational website, accessed January 2013.

- ↑ Paul Blumenthal and Ryan Grim, CRFB Corporate Ties: Budget Watchdog Funded By Big Tobacco In 1990s Health Care Fight, Huffington Post, January 24, 2013.

- ↑ Institute for Policy Studies, The CEO Campaign to ‘Fix’ the Debt: A Trojan Horse for Massive Corporate Tax Breaks, organizational report, November 13, 2012.

- ↑ 42.0 42.1 Peter G. Peterson Foundation, New America Foundation/Committee for a Responsible Federal Budget, organizational website, accessed January 2013.

- ↑ Peter G. Peterson Foundation, Comeback America Initiative, organizational website, accessed January 2013.

- ↑ Peter G. Peterson Foundation, Committee for Economic Development, organizational website, accessed January 2013.

- ↑ Peter G. Peterson Foundation, Concord Coalition Corporation, organizational website, accessed January 2013.

- ↑ Nancy Cook, Billionaire Peterson Sounds Alarm on Deficit, National Journal, November 26, 2012. NB: CAP received half a million dollars from the Peterson Foundation in 2011.

- ↑ Honeywell, "2011 Annual Report", organizational report.

- ↑ 48.00 48.01 48.02 48.03 48.04 48.05 48.06 48.07 48.08 48.09 48.10 Institute for Policy Studies, "A Pension Deficit Disorder: The Massive CEO Retirement Funds and Underfunded Worker Pensions at Firms Pushing Social Security Cuts", organizational report, November 21, 2013.

- ↑ 49.0 49.1 49.2 49.3 49.4 Citizens for Tax Justice, data compiled by CTJ, on file with CMD.

- ↑ General Electric, "2011 10K Form", organizational document, page 27.

- ↑ Verizon, "2011 Annual Report", organizational document, page 25.

- ↑ Corning, "2011 Annual Report", organizational report, page 63.

- ↑ Merck, "2011 10K", organizational document, page 41.

- ↑ Delta Air Lines, "2011 Annual Report", organizational document, page 24.

Portals: Koch Exposed · FrackSwarm · CoalSwarm · OutsourcingAmericaExposed · ALECexposed · NFIBexposed · Fix the Debt · State Policy Network · All Portals